If you own a property in Warangal, Telangana, you must pay the GWMC tax. The Greater Warangal Municipal Corporation (GWMC) houses tax every year. The GWMC is the civic authority in charge of the city’s administration. Property owners in Warangal can pay their GWMC house tax via the civic body’s website, which has made the process entirely hassle-free.

Here’s how to pay your Warangal property tax. We give the details about the GWMC House Tax on this page. So, read this page thoroughly to know more about the Greater Warangal Municipal Corporation House tax.

Contents

GWMC Property Tax:

Greater Warangal Municipal Corporation (GWMC) is Telangana’s oldest local government. The GWMC covers 407.77 square kilometres. According to the 2011 Census, the population of the corporation is 8.30 lakhs, with thousands of houses and properties. The company collects taxes from property owners, shops, and other businesses to fund the city’s development.

It is required to file a property tax return if any person possesses any property for commercial or industrial uses and residential property because the property tax is one of the critical sources of revenue of GWMC.

All residential, commercial, and industrial properties in GWMC must pay taxes. Otherwise, the corporation will charge the GWMC Property/House tax interest. As a result, you should pay your GWMC taxes as soon as possible.

GWMC Pension Apply Online & Check the Status of Pension Application

GWMC House Tax Payment:

The citizens who have a property in Warangal have to pay the tax to the Warangal municipality. The citizens can pay the tax online, like home tax, water tax, etc., on the official website of the GWMC. The steps for paying the tax online is as follows. The steps are:

- Visit the official website of the GWMC.

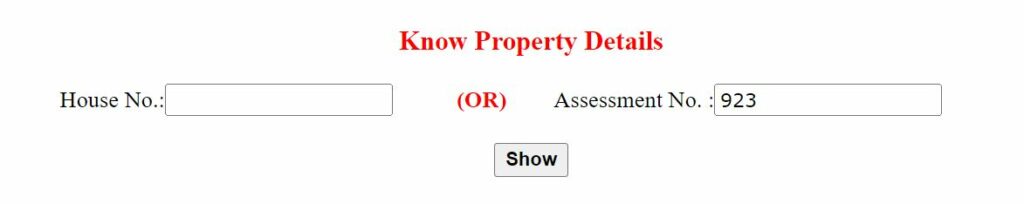

- Enter the house number or Assessment number in the box.

- Then click on the Show button for pending taxes on that particular entry number.

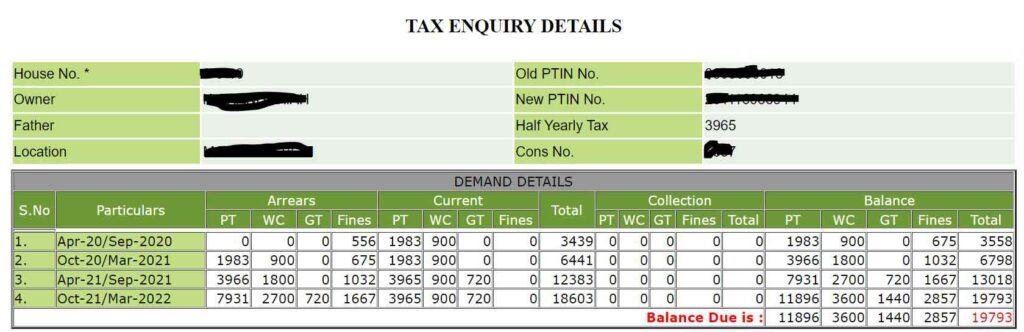

- On the next page, you will get the tax details.

- Select the tax option to get the complete details about the tax.

- Then, select the payment option on the next page.

- Enter the payment details and pay the house tax on the payment page.

- In this way, you can pay the GWMC House Tax.

How can I check my house tax in Warangal?

You can check the house tax in Warangal by visiting the official website of the GWMC. The steps for checking the house tax are as follows.

- Visit the official website of the GWMC.

- You can find the “Enquiry” option on the menu bar on the home page.

- Click on the button to get a drop-down menu.

- Then select the “Tax Enquiry” option and click on the link.

- You have to enter the house number or assessment number on the next page.

- Then click on the show details button to get the tax details online.

- Thus, you can check the details online.

GWMC Trade License Online Application, Fee, Status & Download

How do I pay property GWMC House tax in Warangal?

The citizens of Warangal district can pay the tax online in the following ways. The steps for paying the property tax are as follows.

- Visit the official website of the GWMC.

- You can find the “Our Services” option on the menu bar on the home page.

- Click on that link, and from the drop-down, select the property tax option.

- Then another drop-down will appear on the screen.

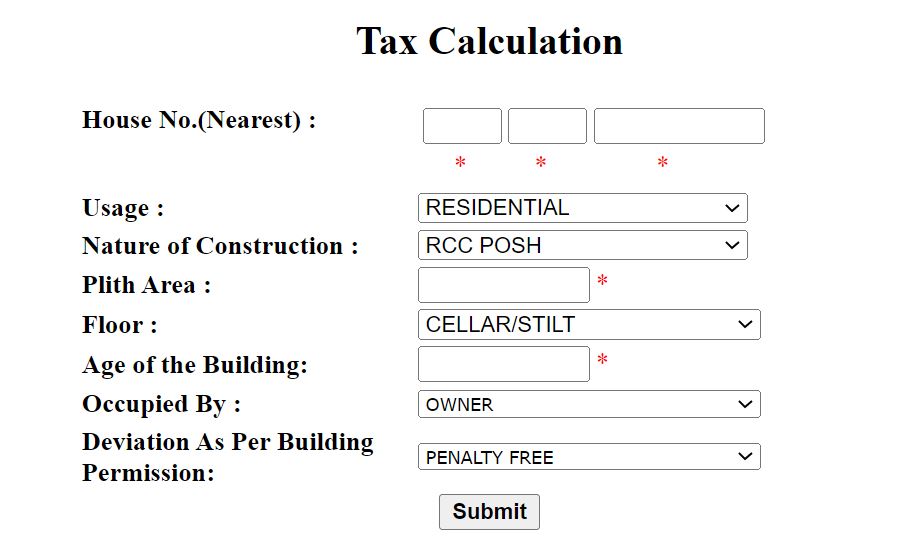

- Select the ” Calculate the Property Tax” option from the available options.

- Enter the details like House number Own or rented etc.

- After entering all the required details, click on calculate to find the tax.

- You can also find the option to pay the property tax online on the official website itself.

Self-assessment of GWMC House Tax:

the citizens of Warangal can also get the facility to apply online for the self-assessment through www.gwmc.gov.in for house tax. The steps for applying are as follows.

- Visit the official website of the GWMC.

- You can find the option ” Online self-assessment application” on the home page.

- Click on that link, enter the details required and submit the application.