Today with this article, we will provide you with all the details related to Rythu Group Life Insurance Scheme. It is popularly known as Rythu Bheema Pathakam.

With this article, we share all the necessary details regarding this scheme. It mainly includes the eligibility criteria, required documents, benefits, objectives and all the features this scheme ensures.

We also provide a detailed step-by-step procedure through which you can easily apply for this scheme. Hence you will not face any problems or inquiries.

Contents

- 1 Rythu Bheema Pathakam

- 1.0.1 The objective of the Rythu Bheema Pathakam 2022

- 1.0.2 Benefits of Rythu Bheeema Pathakam

- 1.0.3 Salient features of the scheme

- 1.0.4 The Statistics of Rythu Bheema Pathakam

- 1.0.5 Eligibility Criteria

- 1.0.6 Rythu Bheema Pathakam Claim Download Form

- 1.0.7 Department Login Procedure

- 1.0.8 Procedure to Check Contact Details of District Nodal Officers

- 1.0.9 How to check the Application Status?

- 1.0.10 Mobile Application of Rythu Bheema Pathakam

- 1.0.11 Helpline Number

- 1.0.12 Frequently asked questions

Rythu Bheema Pathakam

Telangana State Government has formulated and implemented an innovative scheme to guarantee monetary and standardized savings to all farmers.

It is known as Rythu Shwaga Life Insurance Scheme or Rythu Bhima. It has several activities in the agribusiness segment. This scheme is the first of its kind.

It is one of a kind in the entire country and had based on rancher-wise online land information base through MIS as well as information technology and online portals. All endeavour authorities use it for viable and effective implementation.

The objective of the Rythu Bheema Pathakam 2022

- This Rythu Group Life Insurance Scheme (Rytu Bhima) aims to provide money for relief and everyday savings to all relatives/wards.

- It is in case farmers lose their lives.

- In case of loss of life of any cattle rearer, their families face severe money-related problems in any event for their daily needs.

- Ranchers Group Life Insurance The scheme guarantees financial security.

- They help the oppressed members of the ranching family.

- All ranchers between 18 to 59 years are eligible to apply for this plan.

- Life Insurance Corporation of India Legislature pays the entire premium.

- In case of death of any selected rancher from any cause, including simple death, within ten days, Rs. 5.00 will deliver a lakh guarantee amount into their bank account.

- This scheme will significantly impact the lives of all downtrodden families.

- It provides help regarding their professions.

- Since many of these are extremely poor small ranchers and live in areas that are more vulnerable to the common people

Benefits of Rythu Bheeema Pathakam

It is a Rythu Group Life Insurance Scheme for the state of Telangana. Under this, the government insurance amount is Rs. 5.00 lakhs. The amount will be instantly deposited into the nominated nominee’s bank account within ten days.

The scheme is liable only in the case of the death of a registered farmer due to any cause, including natural death.

Salient features of the scheme

- Telangana government wants to benefit all the farmers no matter what the cost.

- The higher the premium, the better likely it is to choose life insurance over accident insurance.

- It is the first time in record that insurance of 5 lakh per person has been provided.

- The group insurer is also one of the largest members in the history of insurance companies.

- The life insurance scheme introduced by the Telangana government for farmers is a new record.

- As estimated by the state government, the government will provide this special insurance policy to 58 lakh agricultural workers in the state.

The Statistics of Rythu Bheema Pathakam

- Districts: 32

- Divisions: 108

- Mandals: 568

- Clusters: 2245

- Villages: 10874

- Farmers: 5715870

Eligibility Criteria

There is an eligibility criterion for all the farmers who want to apply for this scheme. They have to follow the eligibility criteria mentioned below:-

- Firstly, the aspirants must be permanent residents of Telangana State.

- The agriculturalist must be a permanent citizen of India.

- The candidate should also be a farmer by profession.

- A farmer must also own some agricultural land.

- All applicants working on rented land are not eligible. They cannot apply for this scheme.

Rythu Bheema Pathakam Claim Download Form

Anyone can claim their insurance money after the death of their nearest relative, who is a farmer. They have to follow this simple process:-

- First, open the official website of the Rythu Scheme.

- On the notification, you need to download the claim form.

- You can download it from the link provided here.

- You have to fill out the claim form and submit it to the hospital while collecting the dead body of your relative.

- People can also submit documents at LIC Bank.

- Along with that form, you need to submit the death certificate.

- Finally, the concerned officer will transfer the amount to the beneficiary’s account.

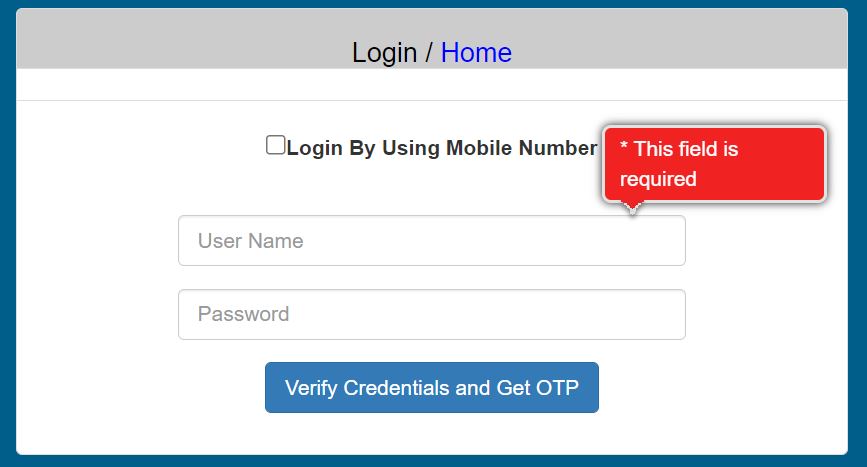

Department Login Procedure

- Please visit the official website of Rythu Bheema Pathakam.

- The main page will display in front of you.

- Click on the department login option on the homepage.

- Consequently, a new page will appear in front of you.

- It would be best if you keyed in your username and password along with the captcha code.

- Finally, click on the Login button.

- With this simple procedure, you can log in to this portal.

Procedure to Check Contact Details of District Nodal Officers

- Open the official website page of Rythu Bheema Pathakam.

- The main page will display in front of you.

- On the homepage, click on the Contacts option.

- Now please click on the District Nodal Officer option.

- As a result, the list of District Nodal Officers will appear in front of your screen.

How to check the Application Status?

One can easily check their application status for insurance money. Applicants must visit LIC bank every time until the concerned authorities resolve their form.

The concerned officials of LIC said that it would settle the insurance claim immediately after the farmer’s death due to many common causes.

Mobile Application of Rythu Bheema Pathakam

The mobile app for Rythu Bhima Scheme is available to everyone. It will help you to get the latest information regarding this scheme. It is very easy to use.

You can easily download this app from the official website by following some simple steps:

- First, navigate the official website of the Rythu Scheme portal.

- A web page will appear.

- Tap on the “Download Mobile App” option, which you can get in the menu bar.

- Download and install that app on your phone.

- Provide required permissions and then login/register.

Helpline Number

Anyone with any queries regarding this scheme can contact their district nodal officer.

People can call 040 2338 3520 and email comag-ts@nic.in.

Frequently asked questions

The scheme’s main objective is to provide immediate and adequate financial assistance to the family members/her dependents in case of the death of the farmer/due to any reason. Most farmers are small and marginal farmers, and agriculture is their sole source of livelihood.

18 to 59 Years Farmer Group Life Insurance Scheme provides financial security and relief to family members. Farmers with an 18 to 59 age limit can register under this scheme.

You can check your application’s status by visiting your nearest LIC branch.