Checking one’s account balance is essential for those with a savings account. It assists the customer in keeping track of their finances. You can read Indian Bank Balance check.

Checking their balance helps them know how much money they have spent and the remaining amount in their account. It also assists them in keeping track of any fraudulent activity and tracing money in their account without reason.

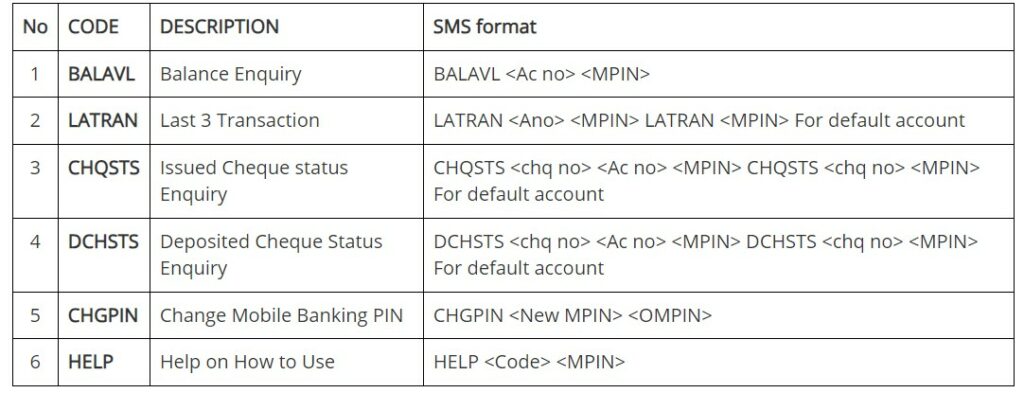

| Balance Enquiry through SMS | SMS BALAVL <Ac no> <MPIN> to 9444394443 |

| Net Banking | website |

| Balance Enquiry through Missed Call | Miss call on 8108781085 |

| Mini Statement by Missed Call | Type LATRAN <Ano> <MPIN> LATRAN <MPIN> to 9444394443 |

| Mobile Banking | IndOASIS |

| Balance Enquiry through USSD | Enter *99# |

Customers of Indian Bank have five alternatives for monitoring their account balance. This page will give information about the Indian bank balance check methods for checking the balance in various methods. So, read this page thoroughly to get more information.

These are ways to check the Indian balance.

- Indian bank balance check number

- By sending SMS

- Through Net banking

- IndOASIS App

- USSD Banking

- Using ATM

- BHIM UPI App

Toll-Free Numbers for Indian Bank

| Indian Bank Balance Check Number | 1800 4250 0000 |

| SMS Banking | 94443-94443 |

| Missed call | 8108781085 |

Contents

How to check a balance in an Indian bank?

There are many ways to check your bank balance. You can refer to the following ways to check your bank balance without visiting the bank.

It is essential first to register your mobile phone number with the bank. You can also use Indian Bank’s SMS service, a missed call, an ATM, online banking, or a mobile app to check your account balance.

- For Check balance through SMS: send the message “BALAVL” to 94443-94443.

- For checking the balance through missed calls: call +91 92895 92895

How to check an Indian bank balance by mobile number?

Many people have this question. For this, you have to register your mobile number for mobile banking services. Then follow the below steps to check your bank balance using your mobile number. You can check the balance by SMS or by missed call.

Steps to check balance through SMS:

Customers without internet access or online accounts with Indian Bank can use the SMS service to check their account balances.

To do so, the customer must first register their mobile number at the home branch using the SMS banking application form and then use the SMS facility after receiving the MPIN and confirmation message confirming the registration of their mobile number. The following are the steps to take:

- Register your cellphone number at the home branch of your account.

- To find your balance, message Indian Bank at 94443-94443 in the format specified below once you’ve got the MPIN.

- After that, Indian Bank will respond to your request by sending you an SMS with your account balance.

Customers can use the SMS service to check their account balance, request a mini-statement, and track the status of their written check. Customers should text 94443-94443 in the format below to Indian Bank.

Steps to check balance through missed calls:

If a customer’s mobile number is linked to an Indian Bank savings account, they can use the missed call service to check their amount. Customers must complete the steps outlined below to use this service:

Customers must register their phone numbers with Indian Bank to use the service.

After that, the customer must phone 09289592895 and leave a message to find their balance.

When the bank receives a missed call from a customer, it will send an SMS with their account amount.

09289592895 is the Indian bank balance enquiry number.

Indian bank balance enquiry:

You can also check your bank balance in the following ways too.

Steps to check balance through Net Banking:

Customers with an Indian Bank Internet banking account can check their account balance by following the below steps.

- Visit the online banking facility of Indian Bank.

- Select the ‘personal banking’ option from the main page.

- To access your account, enter your username and password.

- To proceed, you must agree to the bank’s terms and conditions.

- After you’ve logged in, go to the left-hand side of the screen and click the ‘accounts’ button.

As soon as you do so, the balance in your account will appear on the website. To view your latest transactions, go to ‘detailed statement.’

Steps to check the balance at the ATM:

Customers of Indian Bank can also check their account balance at any ATM of their preference. To do so, customers must complete the steps outlined below.

- Go to the ATM that is closest to you.

- Insert your Indian Bank debit card into the ATM.

- Select ‘balance enquiry’ from the drop-down menu.

- The balance in your account will display on the ATM screen.

Visit the official website for more information.

IndOASIS App

Through the app also, you can check your bank balance. IndOASIS is Indian Bank’s mobile banking application available in Google Play Store. Apple users also can download apps.

BHIM UPI APP

- Open any UPI app on your smartphone.

- Enter the code to unlock the app.

- Go to the ‘Accounts’.

- Select the Indian Bank account number.

- Enter your UPI PIN to get your account balance.

Conclusion

There are several ways you can check your Indian Bank Balance through SMS, net banking, visiting ATMs, and Mobile Applications.

FAQs

He has to type “BALAVL 989898989 5555” and then send it to 9444394443, after validation the customer will receive the SMS of the account Balance outstanding.)

To obtain your Indian Bank mini statement, leave a message at the Indian Bank mini statement miss call number 8108781085 or 180042500000. However, remember that when calling the Indian Bank mini statement number, you should always use your registered mobile number.

Step 1: To view your passbook, log in to the Indian Mobile Banking app with your MPIN and look for the “m-Passbook” area. Tap to activate this option. Step 2: On the next screen – enter your account number and press the view button. You may now see your account’s transaction history.

International Debit Card with Wide acceptance globally. Usage limit of Rs.50,000/- in ATMs and Rs.1,00,000/-in POS & online purchases.