Here’s how users can pay land tax in Kerala online by visiting the official portal of the state revenue department.

Contents

- 1 Pay Land Tax Online in Kerala

- 1.0.1 What is Land Tax?

- 1.0.2 Land Tax Rate in Kerala

- 1.0.3 How is land tax calculated in Kerala?

- 1.0.4 Necessary documents

- 1.0.5 How to Pay Land Tax Online in Kerala?

- 1.0.6 How to Pay Land Tax Online in Kerala via Sanchaya’s official portal?

- 1.0.7 Verify land details in Kerala.

- 1.0.8 How can I check my land records?

- 1.0.9 Frequently Asked Questions

Pay Land Tax Online in Kerala

Property owners such as lands, plots or houses in Kerala must pay land or property tax to the concerned area’s local authority or village office. Land tax is payable once or twice in an assessment year.

Kerala Revenue Department provides a web application called Revenue Land Information System (ReLIS) to maintain land records and enable online land tax registration and payment.

During the budget in March 2022, the government announced that it would revise the introductory land tax rates in all slabs and introduce a new slab for land above 40.47 acres in panchayats, municipalities and corporations.

What is Land Tax?

Also known as property tax, land tax is a fee levied by state and union territory governments on property purchases. In Kerala, the land owner under the revenue department has to pay tax based on its use. The property owner has to pay taxes every year.

The revenue generated by each local urban body and panchayat had used for the maintenance and development of civic amenities for the citizens and the locals. Land tax is calculated and reviewed online by the Kerala Revenue Department.

Land Tax Rate in Kerala

- According to the new budget, land in gram panchayat divisions above 20 cents @ Rs. 8/R will be taxed.

- Here R stands for 1,000 square feet area.

- For municipalities, 6 cents of land to Rs. 10/R. However, for land above 6 cents, Rs. 15/R will be taxed.

- For corporations, land under 4 cents Rs. 20/R is determined. The tax rate on lands above 4 cents is Rs. 30/R.

How is land tax calculated in Kerala?

Land tax in Kerala is calculated based on current circle rates, land area, and property age, among other factors.

Necessary documents

A property tax bill is a necessary document while paying property tax. The municipal authority issued the property tax bill and sent it to the property address. While paying property tax online, the details such as name mentioned in the statement, property ID etc., must enter.

How to Pay Land Tax Online in Kerala?

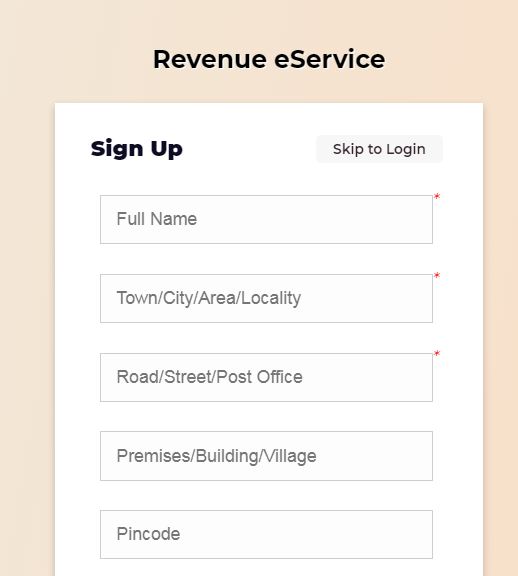

- Firstly Visit the ReLIS website or also called Kerala Revenue Department.

- First-time users can register to avail of e-services by clicking on ‘Register’.

- Click ‘Login’ to login into the portal using your registered mobile number and password.

- After you log in to e-Services, click on ‘New Request’.

- Select the ‘Payment of Land Tax’ option.

- Then accept the message for the taxpayer displaying on the screen by clicking on ‘Confirm’.

- On the payment request page, provide the details like District, Taluk, Village, Block Number, Thandapar Number, Survey Number etc.

- Click ‘View and Add’ to ensure the details are correct.

- Users will get a notification that the details have been added.

- Submit details like the applicant’s name, date of last tax payment, last receipt number etc.

- Connect on ‘Pay Tax’ to pay Kerala Land Tax online.

- The next page will appear for payment details. Click on ‘Pay Now’.

- You will redirect to the payment screen.

- Select the preferred payment option (e.g., Net Banking, Card Payment, UPI Payment).

- Click on ‘Proceed for Payment’.

- After successfully paying Kerala land tax online, the user will receive a receipt that can be downloaded and saved for reference.

How to Pay Land Tax Online in Kerala via Sanchaya’s official portal?

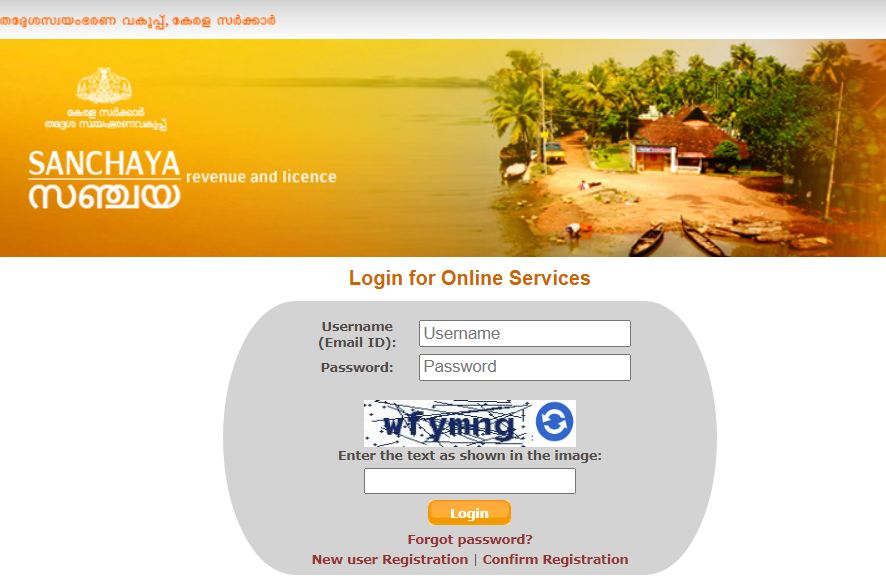

- Register on Sanchaya’s official portal and generate a unique ID and password.

- Select ‘Citizen Login’ for accumulation and enter the generated ID and password.

- You will redirect to Kerala Local Self Government (LSG) website.

- On this website, register if you are not a user.

- Select the ‘Payment for Registered User’ option if you are already a user.

- Enter the required details along with the Captcha code.

- Confirm your registration.

- You will redirect to a new web page.

- After completion, go to the Sanchaya website for ‘Citizen Login’.

- You will turn to Kerala Local Self Government (LSG).

- Select the concerned Municipality or Gram Panchayat, District and Corporation. Press the submit button.

- Local organizations had displayed on the webpage.

- Click on the E-Pay button.

- You will redirect to a new web page again.

- Select the ‘Property Tax’ option and fill in the required information for Ward Number, Door Number and Sub Number.

- The verified property tax details and the pending tax amount will display.

- Enter your e-mail ID and mobile number along with the captcha code.

- Select the ‘Pay Now’ option. Find a suitable payment option and pay the land tax online.

Verify land details in Kerala.

- To verify land Info in Kerala, go to the ReLIS website. And click on ‘Verify Land’ in the top menu bar.

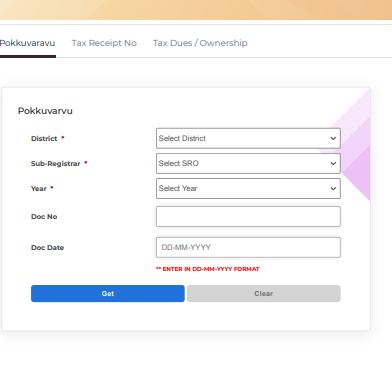

- There will be options – tax return, receipt number and tax dues/ownership.

- Click on an option according to your requirement.

- To view Pokkuvaravu details, select District, Sub-Registrar, Year, Document Number and Date.

- Click on ‘Get’ to view the document information.

How can I check my land records?

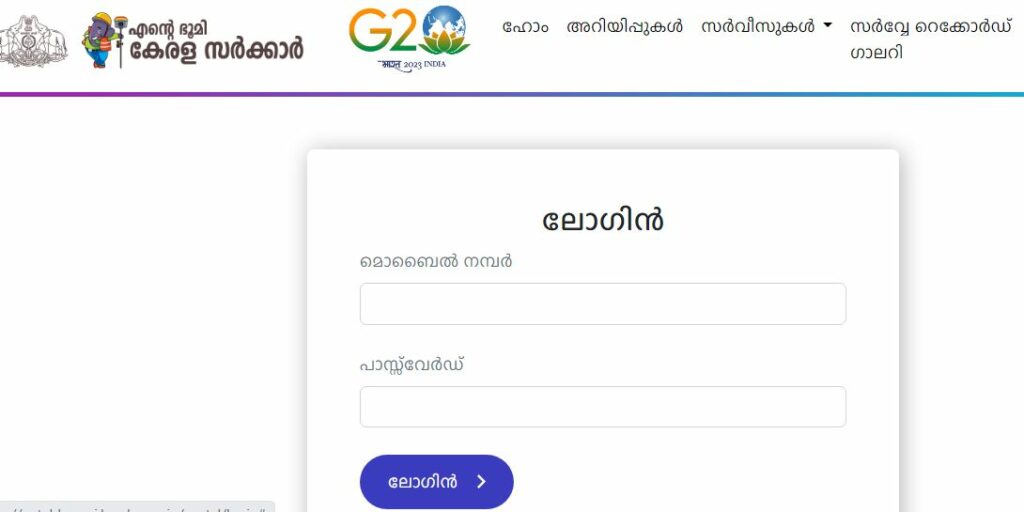

The Government of Kerala provides an online portal called E-Rekha through Bhumikeralam. This web-based survey records data directory enables citizens to find land ownership info or cadastral data related to the Survey and Land Records Department.

- Visit e-Line through the Bhumi Keralam website.

- First-time users can sign up on the web portal. Then log in to the official website using their credentials.

- Click on ‘File Search’ given in the top menu bar.

- There will be three options – district maps, old survey records, and resurvey records. Click on a choice according to your requirement.

- Select District, Taluk, Village and Document Type from the drop-down list

- Provide the Survey Number and Block Number. Click on ‘Submit’.

- You can preview the document. Click on ‘Checkout’ to download the copy.

Note: Users logged into the website must verify the essential details and pay the document fee to download the survey records.

Frequently Asked Questions

Kerala Revenue Department earns revenue by levying the land tax. This tax money had used to develop areas under the jurisdiction of Municipal Corporations and Panchayats.

The revenue department surveys a place and determines the area’s circle rate and land tax based on prevailing prices.

The procedure of mutation of land or property is called Pokkuvarao in Kerala.

Land tax is levied on any vacant land unless used only for agricultural purposes.