Punjab Government has introduced (Integrated Financial Management System) IFMS Punjab to collect payments from various departments. Through the IFMS Punjab portal, users can pay challan online or offline to the treasury and department without going anywhere.

Users need to register on the IFMS Punjab portal to pay challan through online mode. In this article, we provide detailed information about IFMS Punjab, i.e. how to login into the portal, register, and challan generation payment online/offline procedure, update Profile, account, verify the payment, verify challan etc.

Contents

- 1 Facilities under IFMS Punjab

- 1.0.1 What are the Advantages of IFMS Punjab?

- 1.0.2 Service under IFMS Punjab

- 1.0.3 How to Register in IFMS Punjab for Challan Payment?

- 1.0.4 How to log in to IFMS Punjab?

- 1.0.5 Pay challan in IFMS?

- 1.0.6 How to verify challan?

- 1.0.7 Forgot GRN Number?

- 1.0.8 IFMS Punjab Treasury Login

- 1.0.9 Contact Details

- 1.0.10 FAQs

Facilities under IFMS Punjab

IFMS is a mechanism for implementing effective financial control over public expenditure by government departments in the state. Treasuries manage opening and subsidiary accounts of payment in real-time.

District treasuries receive money from the public and departmental officials through banks for credit to the government. Further, the treasuries disburse pensions acting as Officer and A.G. All PPOs issued by Punjab are routed to banks by Treasuries.

What are the Advantages of IFMS Punjab?

- Using Receipt Target Module, the State Government allocates monthly receipt targets to the receipt departments like Excise, Taxation and Transport.

- The vehicle management system has saved more than 17 crores.

- They are using GPMS, the State Govt. You can check the availability of vacant office space at a particular location; hence, they can reduce office costs.

- eReceipt’s smart dashboards have helped state govt. 13.50 crore in recovery from banks.

- Unique Payee Codes have reduced 98% of R.N.s (Return Notes) from eKuber (RBI), thus facilitating seamless payments.

- Integration with NSDL has improved the data accuracy of NPS employees and facilitated time deposits.

- Employee collaboration.

- Integration of Receipt and Refund, A.C. and D.C. Bills, and EMD & PD/PLA Bills reduces leakage of funds.

- eReceipt mobile app provides a very easy receipt deposit.

- Deterioration of challans has stopped the repeated use of challans in various treasuries.

Service under IFMS Punjab

- Add Payee

- Salary Paybill

- NPS pay bill

- NPS Arrear Bill

- Budget Review Form

- DDO Level Application Process

- IFMS Receipt

- Employee Transfer

- Budget Allocation Form

- New Employee Payee addition

Apart from the services mentioned earlier, more powers and facilities are provided to the officers in IFMS Punjab to make the department smooth.

How to Register in IFMS Punjab for Challan Payment?

If you want to make yourself on the portal, then follow all the steps mentioned below:

- First, go to the authorised website of IFMS Punjab. On the home page, click on E-receipt Tab.

- After clicking, the login form will display in front of you, where you will see the “Registration User” option given below.

- And click on it.

- After clicking, the registration form will open on your screen.

- First, you need to check the availability of your user I.D. followed by First Name, Last Name, DOB, Email, Address, PAN Number, and Mobile Number, and enter your details like the captcha code.

- After filling in all the info, now click on the registration button.

- Now get OTP to your mobile number and enter the OTP.

- Now you are successfully registered in the portal.

How to log in to IFMS Punjab?

- First, visit the official website.

- On the homepage, click on the e-Receipt tab.

- Now the login page will open on the screen.

- Enter your username and password and fill in the captcha code.

- Now click on the login button.

- Now you have successfully logged into the portal.

Pay challan in IFMS?

- Visit the official website of IFMS Punjab.

- On the main page, you will get the option of the E-Receipt tab and click on the E-Receipt tab.

- Now enter your username and password to the login portal.

- After login dashboard will open on your screen.

- Click Create Profile and fill in the required details like Department, Sub Department etc.

- And click on Make Payment.

- Pay Challan in IFMS

- Now fill in the Challan details like the essential nature of payment, year, duration, amount etc.

- And select your desired mode of payment Cash, Check or D.D.

- Click on submit button.

- Now the payment page will open on your screen, check all details and click on confirm button and a challan has been generated.

- Now you can download the challan.

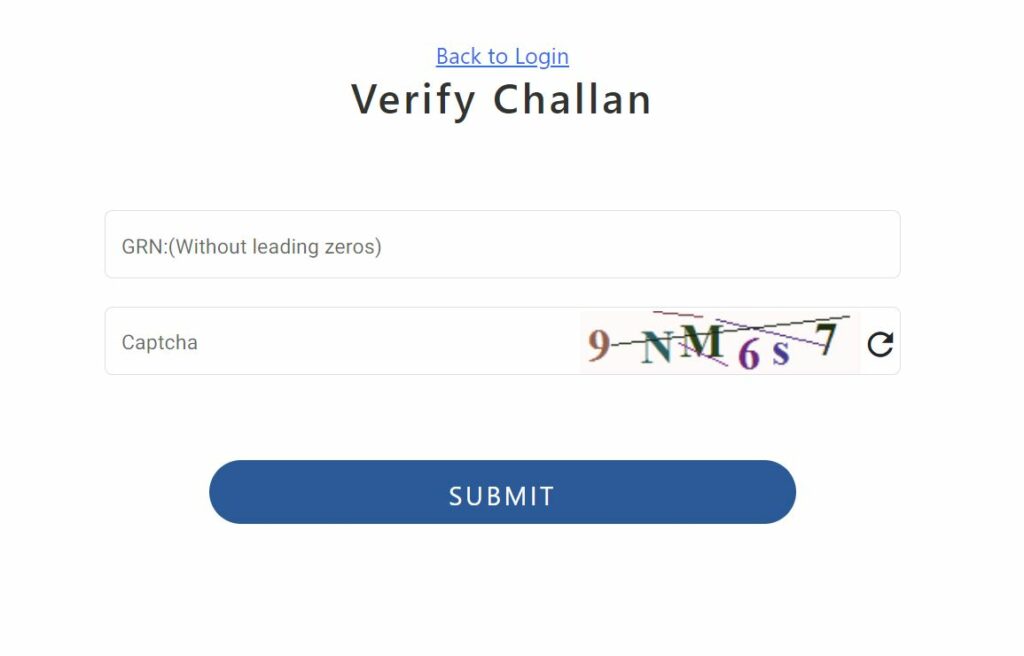

How to verify challan?

- First, visit the official website.

- On the homepage, you will see the receipt tab option.

- And click on the e-Receipt tab.

- On the next page, connect on Verify Challan.

- Now enter your GRN number without leading zeros(0).

- And fill in the captcha code.

- Click on verify challan submit button.

- Now it will display payment challan details.

Forgot GRN Number?

- First, visit the official website of IFMS Punjab.

- On the homepage, you will get the option of the receipt tab and click on the e-receipt tab.

- On the next page, click on Forgot GRN.

- Now select your GRN (By Dept Ref No, By Bank Ref NO, By Bank SIN, By Email ID, Date and Amount, By Mobile Number, Date and Amount) and fill in the captcha code.

- Click on submit button.

- Now it will send the GRNS list to your mobile number.

IFMS Punjab Treasury Login

DDO or above rank officers can log in to Punjab Government Treasury Online Panel.

- The official website to log in is https://ifms.punjab.gov.in.

- Then click on the eTreasury bold text.

- It will take the person to the next page where they must enter username, password and captcha (displayed on screen) and then click login.

- To access the eTreasury Punjab, a person must be allowed to access the location.

- If we deny the location permission, the page won’t open and keeps denying entry.

- We suggest using the Google Chrome browser for the Punjab eTreasury page login.

Contact Details

Email: ereceiptifms@gmail.com

Telephone: +91 82848 20473, +91 82787 73662

FAQs

An integrated financial management system (IFMS) is an IT-based accounting and budgeting system that manages expenditure, payment processing, reporting and budgeting for governments and other organisations. An IFMS bundles several important financial management functions into one software suite.

IFMS is a non-refundable charge diluted as soon as the welfare society has formed. It is a one-time payment (including taxes) usually classified as a hidden charge. 18% GST will be levied at the time of payment.

Next Gen IFMS is a whole suite of applications used by the government. Punjab is for planning, budgeting, receipts and expenditure control, payment processing, debt management and audit. This state-of-art portal had owned by the Finance Department, Govt. of Punjab and developed by NIC Punjab.