A PAN Card (permanent account number) is a ten-digit range essential for each human’s revenue enhancement functions and identification proof. Then it’s issued to assess people, companies, and firms. Here are some steps to apply for a pan card.

IT Department collectively issues e-PAN from Associate in Nursing electronic reasonably PAN Card and is digitally signed. It’s soundproof for allotment of PAN.

That international organization agency is required to file taxes and ought to have a PAN. A global organization agency that does economic or financial transactions where PAN Card is critical should have a PAN.

Contents

Structure

A PAN card contains vital data like name, father’s name, date of birth, address, signature, photograph, and PAN card number. However, there’s a specific format followed in the allotment of a PAN card number.

What is PAN Card? How to Change Name on PAN Card?

The PAN card number is a ten-digit alphanumerical figure containing each number and alphabet. In ten-digit alphanumerics of PAN card are:

- The first three letters contain numbers and alphabets;

- The fourth letter represents the class below which the remunerator is classified. For example, the letter P is allotted to individual taxpayers, F indicates firms, C to firms, and L means agency.

- Further, the fifth letter is the initial of the cardboard holder’s last name.

- Out of the remaining five letters, the primary four are numerics. In contrast, the last letter is associated with the alphabet.

History

Before the thought PAN was introduced, it gave a GIR number to taxpayers. It was essentially a manual system and was distinctive solely at intervals ward or below a specific assessing officer.

However, the quantity wasn’t distinctive at the country level. Since GIR Number is distinctive, not distinctive, there might be higher probabilities of misreckoning and errors or mistaken identity cases throughout the assessment.

The Assessing Officer assigned the GIR number to a remunerator and enclosed the Assessing Officer’s data.

In 1972, PAN’s thought was extended by the Indian government and created statutory below section 139A of the revenue enhancement Act, 1961.

At the start of a voluntary method, PAN was designed for all tax-paying people in 1976. The initial PAN range allotments were created manually. Every ward/circle received a precise set of numbers to avoid duplication. This series was abandoned within the year 1995.

Documents Required to Apply for a PAN Card

- Aadhaar card

- Date of birth

- Address proof

- Voter ID

How to apply for a PAN card Online?

Following is the process for applying for a PAN card:

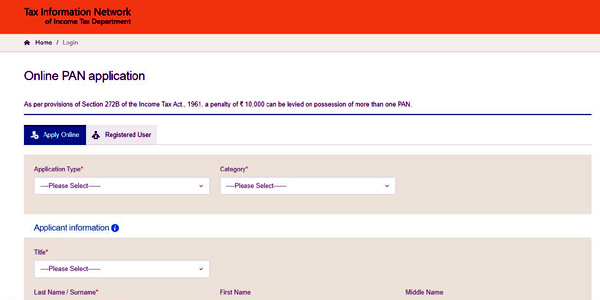

- First, the applicant must go to the official website by typing https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html in the search bar browser.

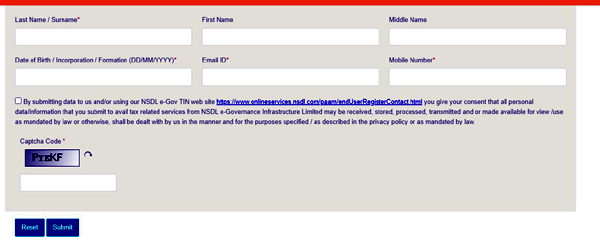

- Now fill out the application form with all your details.

- Attach all the required documents to it.

- You must pay 93 rupees through internet banking, debit, or credit card.

- After your successful payment, you will get an acknowledgement slip on the screen.

- So save that acknowledgement number for further reference.

- Finally, after verification PAN card is sent to you through a courier.

Do’s and Don’t to apply for a PAN card.

Following are the do’s and doesn’t during the filing of the PAN card application form:

- Ensure that should enter the information in capital letters.

- Do not skip any column wherever obligatory data is needed.

- Enter a functioning and active phone number that may keep you updated with messages and calls.

- Cross-verify all details before the ultimate submission of the application form.

- Do not add salutations’ last names, such as Mr, Mrs, Miss, or Dr.

- Enter the proper address so the PAN card is updated suitably.

- Make sure that the documents attached are clear or not.

Types

There are four different types of PAN cards. They are:

- PAN card for individual citizens.

- Government issues PAN cards to Indian companies.

- Government issues PAN cards to foreign companies.

- PAN cards are issued to foreign citizens.

How to correct PAN Card online?

The following process is to correct the PAN card online:

- Applicants need to visit the official site by typing.

- After that, visit ‘Application Type’ and enter OTP for changes or corrections in PAN Data. Select ‘Individual’ as a category.

- Fill in details like Title, Last name/surname, First name, Date of Birth, address, email id, PAN number, whether or not national of the country, and captcha code.

- Once filling altogether check before, you would like to click on ‘Submit.’

- At that time, you will get a message, “We thank you for exploiting the online PAN application service of NSDL e-Gov.

- Your request is with successful Register with Token choice xxxxxxxxx, and so, constant has been sent on your email id provided among the PAN form.

- Click the below option to fill in the remaining PAN sort.” you would like to click on ‘Continue with PAN type.”

- Then automatically redirected to the online PAN application page. Check all the significant points crammed antecedently.

- Then update the details you want to change in the PAN card like name, address, date of birth and surname, etc.”

- If you update the pic and signature on PAN, you’ll be able to do so by clicking ‘Photo’ and ‘Signature mismatch’ on the page.

- Once all the main points unit of measure are crammed, you would like to click on ‘Next.’

- Once you follow all the steps, you will generate an associate acknowledgement slip.