Become a LIC agent LIC of India offers various life insurance and health insurance schemes for the benefit of its customers. You can purchase these plans from LIC agents or online.

LIC agents are people associated with an insurance company who encourage and guide customers to purchase a LIC plan per their needs and requirements.

These agents do not need to visit the branch office daily to carry out their work. They can perform their work online by logging into the LIC agent portal.

Contents

- 1 Eligibility Criteria for becoming a LIC agent

- 1.0.1 Responsibilities of LIC Agent

- 1.0.2 The process of becoming a LIC agent

- 1.0.3 What is the Salary of a LIC Agent?

- 1.0.4 How to Register in LIC Agent Portal?

- 1.0.5 How to login into LIC Agent Portal?

- 1.0.6 Login Process If You Forgot Password

- 1.0.7 How to change a password

- 1.0.8 Online Application Form

- 1.0.9 LIC Agent App

- 1.0.10 Advantages of using Agent Portal

- 1.0.11 Customer Care Details

- 1.0.12 Frequently Asked Questions

Eligibility Criteria for becoming a LIC agent

To become a LIC Agent, candidates must qualify for the LIC Agents Pre-Licensing Examination performed by the Insurance Regulatory and Development Authority of India (IRDA). To occur in the exam, they have to fulfil the criteria mentioned below:

- 10th pass from a recognized board

- The minimum age should be 18 years

Responsibilities of LIC Agent

A LIC agent acts as the first point of contact for many people who purchase an insurance policy from LIC.

They promote the benefits of policies to individuals, families and businesses who want to secure their future protection of life, health and property.

In addition to marketing and selling policies, LIC agents maintain records, assist policyholders in settling claims and advise customers to minimize risk.

Depending on the area of specialization, LIC agents may focus on a single type of policy or offer their services for all types of insurance.

They act as an interface between the insurance company and its policyholders to ensure compliance.

As they get basic training in the insurance industry, they can also become agents of other insurance companies.

The process of becoming a LIC agent

Many youngsters aim to become LIC agents due to the convenience of working hours. Let’s understand the steps to becoming a LIC agent.

- Contact the closest LIC branch office and meet the development authority with basic documents.

- The officer will conduct the interview.

- Successful contenders will undergo training at the Divisional/Agency Training Centre.

- The twenty-five-hour training covers all aspects of the company’s life insurance policies.

- After completion of training, candidates have to appear for the pre-recruitment test conducted by IRDAI.

- With at least 35% in the exam, you can receive an appointment letter from the LIC of India.

- After this, you will also get an identity card to work as a LIC insurance agent.

- You will be posted as a LIC Agent at a branch office and work with a team under the supervision of a Development Officer.

- They will provide you with the necessary field training and details to start your work.

How to become an air hostess after the 12th?

What is the Salary of a LIC Agent?

There is no fixed salary for LIC agents. Commissions on new policies or renewal of old policies generate gross income.

Commission percentages vary significantly based on policy type and agent club.

LIC agents can avail of festive advances, furniture allowances and mobile and telephone bill reimbursements.

The company also provides financial and non-financial rewards based on the performance of individual agents.

Agents also get gratuity and recurring income from renewal commissions after retirement.

How to Register in LIC Agent Portal?

LIC agents can also perform their work online. For this, you have to register in the LIC portal. Here are the steps for registration.

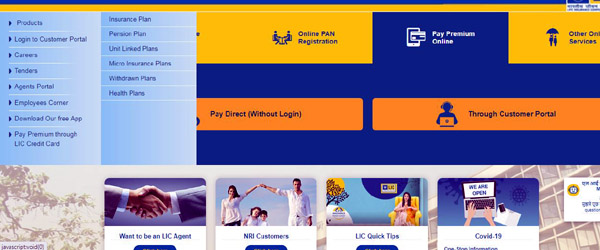

- Visit LIC’s official website.

- Click on ‘Agent Module Helpline’ under the Online Services menu bar.

- A new page will unlock.

- Press ‘Click here to register.

- Enter the pertinent details and then click ‘Generate OTP’.

- An OTP will send to your registered email ID/mobile number.

- Enter the OTP, and your registration is complete.

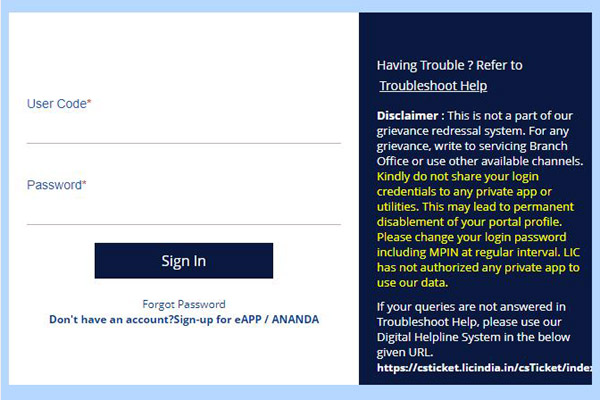

How to login into LIC Agent Portal?

To avail of various online services, LIC agents can log in to the LIC portal by the below-mentioned steps:

- Visit LIC’s official website.

- Click on ‘Agents Portal’ under the Online Services menu tab.

- Select the role as ‘Agent’.

- Enter Agent Code/Email/Mobile Number.

- Enter your password and date of birth.

- Click ‘Sign In’ to continue.

Login Process If You Forgot Password

After creating an online account on the website, there is a possibility that LIC agents may forget the password to log in. If you have forgotten the password, follow the steps mentioned below.

- Visit LIC’s official website.

- Click on ‘Agents Portal’ under the Online Services menu tab.

- Click ‘Forgot Password.

- Enter the agent code.

- Click on ‘Date of Birth’.

- Enter the captcha code.

- Click ‘Submit’.

- They will send your new password to the registered mobile number/email id.

- Enter a new password to continue.

How to change a password

- Visit LIC’s official website.

- Click on ‘Agents/Dev Officers/Bill Pay Enquiry’ under the Online Services menu.

- Click Change Password.

- Enter the user ID and current password.

- Enter a unique password and confirm the password.

- press’Reset’.

How to become a RAW agent after the 12th?

Online Application Form

Eligible contenders can also apply online before being contacted for an interview. Here are the steps to apply to become a LIC agent:

- Visit LIC’s official website.

- Click on ‘Become an Agent (Individual)’ under the Join Our Team menu tab.

- Click ‘Apply-Now’ on the right side of the page.

- Fill out the application form to proceed at the branch office.

LIC Agent App

LIC provides a mobile app to its agents to handle sales of various life insurance policies. You can download this application through the Play Store on Android devices and App Store on iOS devices. Key features of the LIC Agent App had mentioned below:

- Key renewals

- Policy alerts and greetings

- Register and track complaints

- Multi-login platforms for agents

- OTP-based authentication for agents

- Agent’s diary and customer appointments

Advantages of using Agent Portal

Some of the benefits of using the LIC Agent Portal had mentioned below:

- Agents can easily search various insurance policies offered by LIC.

- They can also check the withdrawn plans.

- One can view the dates of their customers’ first unpaid premiums (FUP).

- Check details of lapsed policies.

- Check the maturity of various policies sold to customers.

- Details of the loan taken by their customers against the policy.

How to become a judge in India after the 12th?

Customer Care Details

Helpline numbers are provided to LIC agents to resolve their queries related to the insurance policy. Details mentioned below:

Call: 022-67090501/022-67090502

Email ID: agent_support@licindia.com/dev_support@licindia.com

Frequently Asked Questions

You can check loan details against your client policy by visiting the agent portal or the LIC agent app.

LIC agents can call 022-67090501/022-67090502 for policy-related queries, login, dashboard and others.

Some of them had mentioned below.

1. Claims Enquiry

2. Policy Status

3. ViewPolicy

4. Maturity Alert

5. Register Complaints

6. Lapsed/Revival Details

7. Customer Tracking Tools

8. Complaint Status View