Union Bank of India, known as UBI, offers its customers different types of debit cards, like Visa, RuPay and MasterCard. If one forgets or gets stolen, the most important thing is to suspend/Block a Union Bank ATM card immediately.

Contents

- 1 Block Union Bank ATM card

Block Union Bank ATM card

Union Bank of India (UBI) has also provided several ways for its customers to hotlist a debit card, using various online and offline methods as listed.

Union Bank ATM Block

- Dial the UBI ATM block number from RMN.

- Contacting Customer Card care Toll-Free Number (24*7)

- Requesting by sending an SMS from RMN.

- We are discontinuing service from the U-Mobile app.

- By using net banking services.

- Reporting at any nearby bank of the Union Bank of India Helpdesk

How to block Union Bank ATM Card through the toll-free number

Union Bank ATM Block Number

- 8002082244

- 1800222244

These are the steps you need to follow.

- First, call the bank’s customer service on the toll-free number 1800 22 2244 from the account’s RMN.

- Select the Black ATM Card option by following the IVR menu of the call.

- Verify debit card details and confirm blocking through a call.

- However, if you need any help with your ATM card, contact your call to their executive.

- Let them know you misplaced your card and want to block it.

- They will ask you for information, like your account linked to your ATM card.

- Give them all your information, and your card will be blocked.

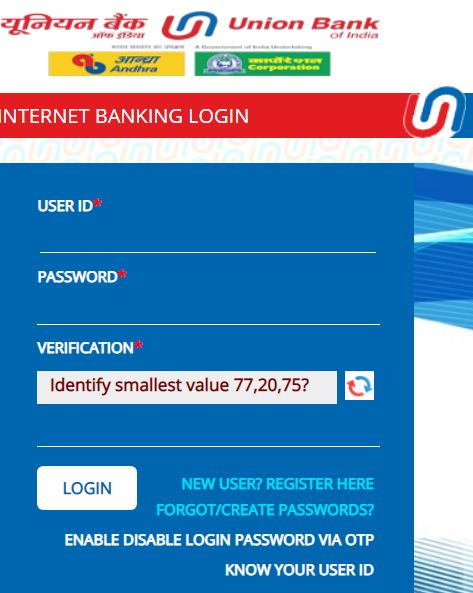

How to Block UBI ATM Cards through Internet Banking

- Utilise your username and PWD to log in to the website.

- Proceed to the “ATM Card Services>Block ATM Card” option from Account Dashboard.

- Select the account you want to block your ATM or debit card.

- A list of active cards had shown with the card’s first and last four digits.

- Select the card and click “Submit” Confirm and verify the information.

- Select both SMS OTP and Profile Password as the authentication method.

- Enter your OTP or password/profile password on the following page and click “Confirm”.

- After blocking your ATM or debit card, a success message with the ticket number will display. Keep a copy of this ticket digit for future utilise.

How to block UBI ATM Card through U-Mobile APP

The application’s sign-up option allows Union Bank debit cardholders to manage their debit cards with easy steps.

- Launch the ‘U-Mobile‘ banking app and log in via MPIN or biometrics.

- Choose the Debit Card Control option from the Account Dashboard.

- Now, select Debit Card Hotlisting.

- Enter your MPIN and select your debit card.

- Verify a debit card is blocked again immediately.

How to Block UBI ATM Card via SMS?

Write and send an SMS from the mobile number of the account shown below.

- UBLOCK<space>xxxx and send to 9223008486.

- In this case, ‘XXXX’ is the last four debit or ATM card numbers.

How to Stop/Block Union Bank of India ATM Card through Bank Branch

- It would help to go to the main branch where you have your bank a/c; otherwise, contact the nearest UBI branch.

- Inform the bank supervisors that you have robbed or forgotten your card and want to block it.

- They will ask for complete bank account details, like your account number.

- Give them all the information or show them your bank passbook.

- Complete and submit the request, and they will also block your ATM card.

For other and complete info, please visit the official website portal of UBI or connect to the customer care helpline number, which will help you 24*7.

FAQs

You can dial this code from any cell phone; ussd code is swift and reliable. To block your Union Bank ATM card, dial *826*21#, input your PIN and proceed.

Have you lost your device? Don’t sweat it! Dial *826 *Phone Number# to block your account from another device.

Card Lock is a security feature that blocks new authorisations on debit and credit cards. If you misplace your card, locking it can prevent criminals from using it until you report it as lost/stolen.

You can visit the nearest branch of your bank to place a request for a new debit card. Meet the Relationship Manager at the department and request a new debit card. You can also ask for an instant debit card at the branch.