Telangana State Online Beneficiary Management Monitoring (TSOBMMS) System started the BC Corporation Loan scheme to support the’ entrepreneurial activities of backwards classes’ financially.

Whether you want to start a small business or are an existing entrepreneur seeking expansion, the BC Corporation Loan can be a valuable resource.

What is the BC Corporation Loan?

The Telangana government started a financial scheme to assist individuals from the backwards classes. It aims to promote entrepreneurship and economic development among marginalised communities in the state.

The following communities can apply for a loan

- Nayee Brahmin

- Washermen/Rajaka/Chakala

- Vaddera

- Sagara(Uppara)

- Valmiki/Boya

- Krishna Balija

- Bhattraja

- Kummari/Shalivahana

- Viswabrahmin

- Medara

Eligibility

The following are the eligibility requirements to apply for a BC loan.

- The applicant should belong to Telangana.

- They must belong to the backwards classes as specified by the state.

- Must meet the age criteria of 18 years.

- The applicant should have a viable business plan and be able to repay the loan.

Required Documents

- Aadhaar Card.

- Date of birth (DOB) certificate.

- BC Caste certificate.

- Income certificate.

- Passport-size photos of the applicant. (greater than 50kb and less than 500kb)

How to apply for a Telangana BC Corporation loan

These are the steps you need to follow.

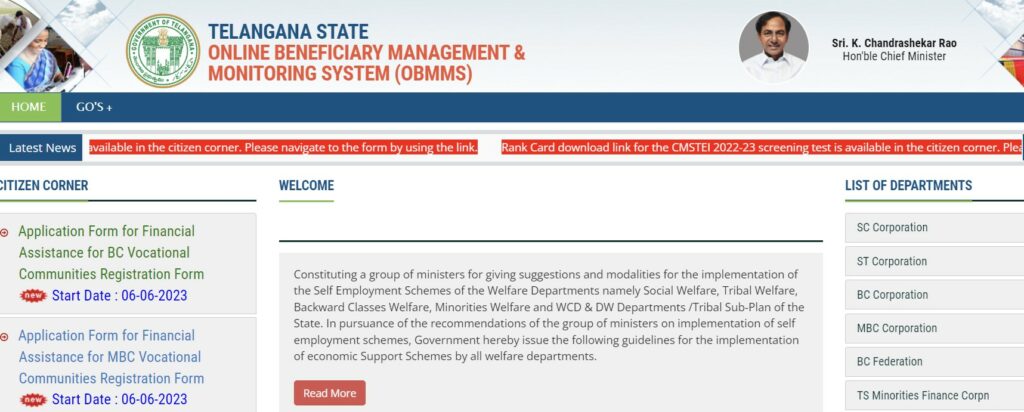

- Go to the official website of the Telangana State Online Beneficiary Management Monitoring (TSOBMMS) System.

- The right-hand “Application Form for Financial Assistance for BC Vocational Communities Registration Form” is in the citizen’s corner.

- Click on it

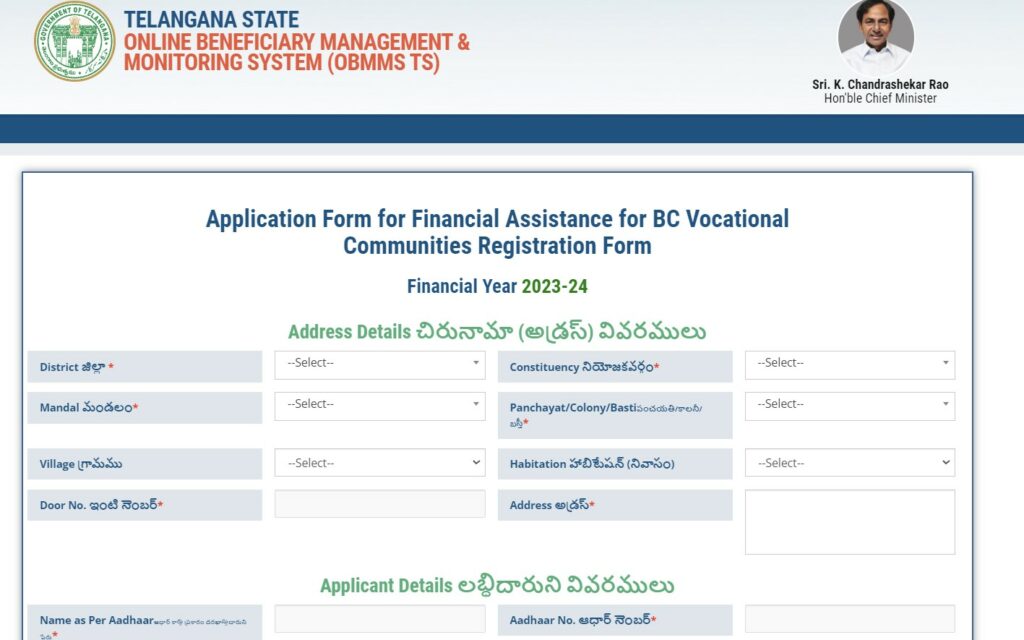

- A new tab will open, where you must enter all the required details, such as Address, Applicant, and sector.

- Please mark on the self-declaration.

- You can see a preview.

- Finally, click on submit.

- You will get the application number. Take a printout for future purposes.

BC Loan Repayment

It is made in instalments, depending on the repayment period selected by the applicant. The repayment period ranges from 3 to 5 years, and the interest rate is 6% annually.

Download Application Printout

Follow the steps.

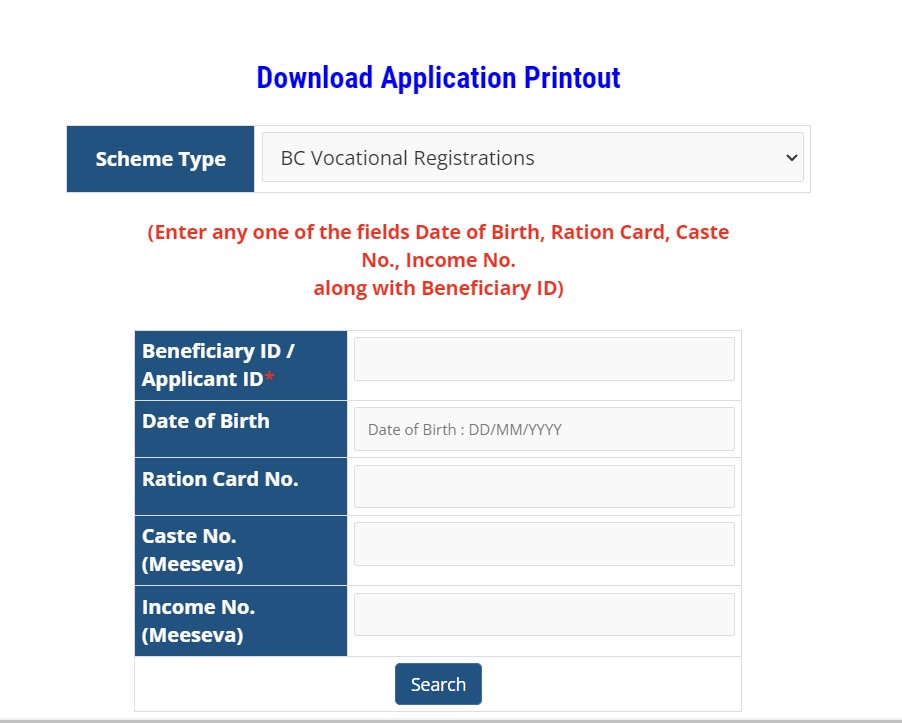

- Go to the official website.

- Click on Download Application Printout on the right side of the Citizen’s Corner.

- The new tab will open.

- Select the scheme type from the drop-down.

- Give the Beneficiary ID/Applicant ID and DOB in all required fields.

- Click on search.

TSOBMMS Sector and Schemes

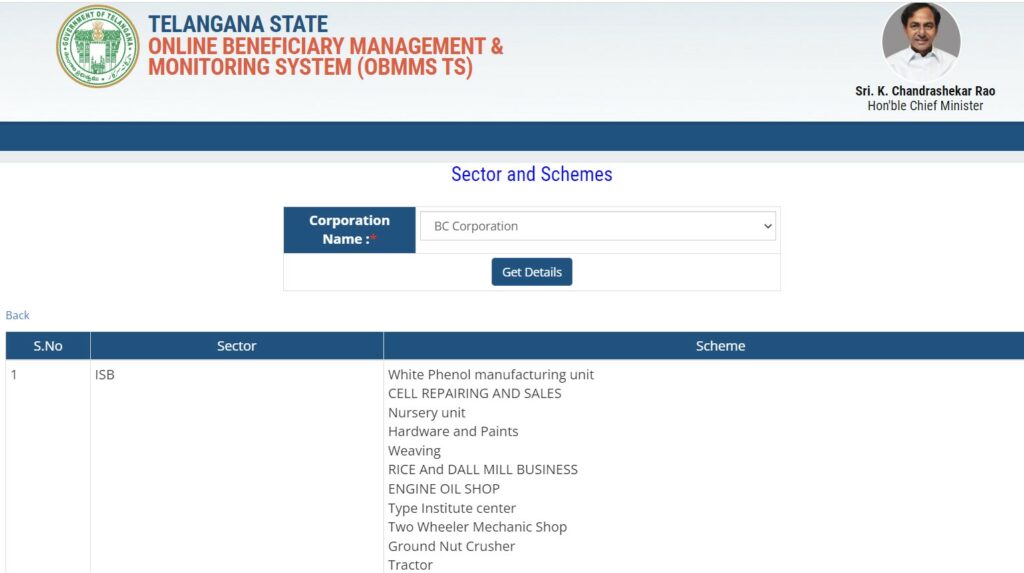

- Go to the official website.

- Click on Sector and Schemes on the right side of the citizen’s corner.

- The new tab will open.

- Select Corporation Name as BC Corporation.

- Click on get details.

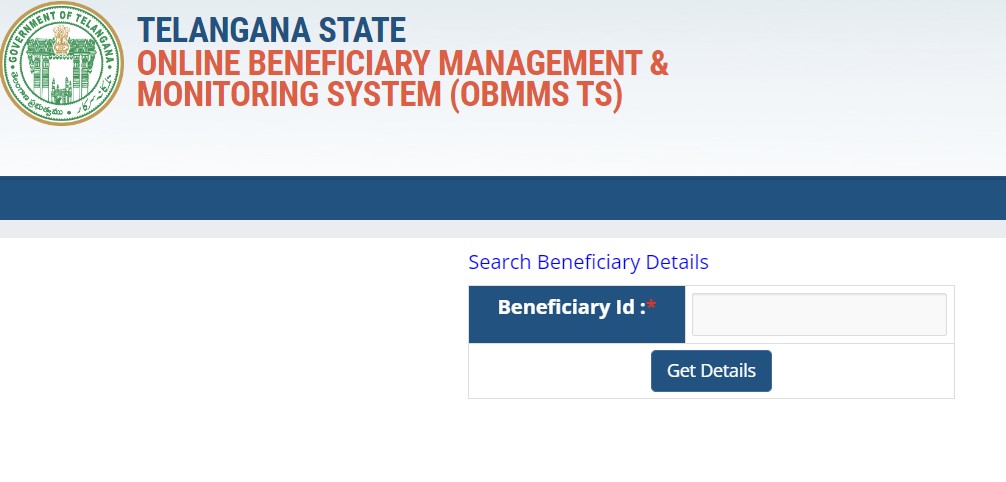

How to Search Beneficiary Details

These are the steps you need to follow.

- Go to the website

- Click on Get Beneficiary Proceedings

- A new tab will open

- Please give the Beneficiary ID.

- Click on get details.

BC Loan Help Line

For any online issues, contact the email below.

Email: helpdesk.obms@cgg.gov.in (Mention corporation name)

Conclusion

The BC Corporation Loan in Telangana is a valuable resource for people from the backwards classes who desire to start or expand their businesses. It offers attractive interest rates, flexible repayment options, and government support, making it an excellent choice for entrepreneurial growth.

Entrust yourself and donate to the financial growth of Telangana State through the BC Corporation Loan!

FAQs

You must be a citizen of Telangana and belong to the backwards classes. You should also have an achievable business plan and the ability to repay the loan.

Yes. Visit TSOBMMS website.

The repayment period can vary from 3 to 5 years, depending on the loan amount and the business.