If you need to remember your vehicle insurance details or lost policy documents, you can quickly check if your vehicle is still insured. From your insurance company, you can narrow your renewal date and other general information for vehicle insurance policy status from your insurance provider.

Contents

- 1 Check vehicle insurance policy status.

Check vehicle insurance policy status.

The Internet has made many insurance transactions efficient and fast. New-age automated insurance providers are at the forefront of providing superior after-sales service. Read on to learn to check your auto insurance status online.

What is the vehicle registration number?

All road vehicles in India must register with a license number. The license number is also called the vehicle registration number or number plate.

The worried state’s Regional Transport Office (RTO) issued the registration number. The registration number plate had placed on the front and rear of the car or bike.

According to the Motor Vehicles Act 1988, the registration digits should be in modern Hindu-Arabic numerals and Latin letters. Also, lights and fonts should be as per the law to make the number plate visible at night.

A vehicle registration number is unique to each state and registered at their locality. Below is the format for Plated Vehicle Registration Number (TS 01 AA 4567) in Karnataka:

- TS or KA, or DL – Indicates the state.

- 01 – RTO where the vehicle is registered.

- AA – When there is no number to give, it has provided to make it unique.

- 4567 – Unique registration number for your car.

Ways to check vehicle insurance policy status Online

There are two scenarios – you may want to check your vehicle’s insurance status or know the car’s accident history that caused the accident. Let’s review two situations.

Suppose you are unfortunately involved in an accident and don’t know the insurance details of the vehicle that caused the accident. In that case, you can find information about the accident vehicle’s history, vehicle registration number, etc.

It is easy to find Through Insurance Information Bureau (IIB). IIB will maintain vehicle records in digital format from 1 April 2010.

You can find car insurance status checks in India through this web portal. Below are the steps you require to follow to check your car or vehicle insurance status policy online:

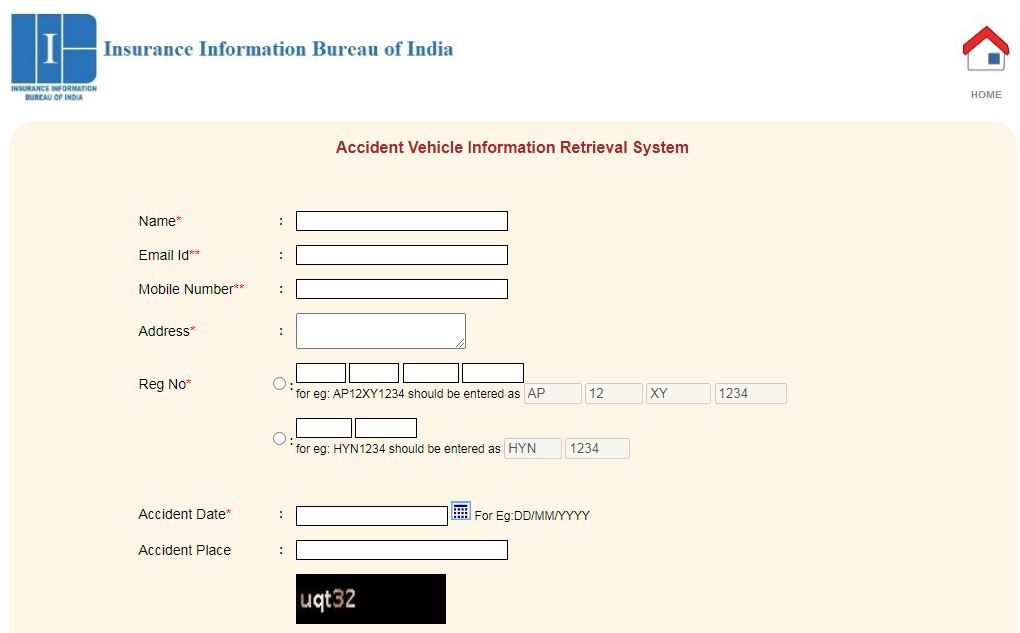

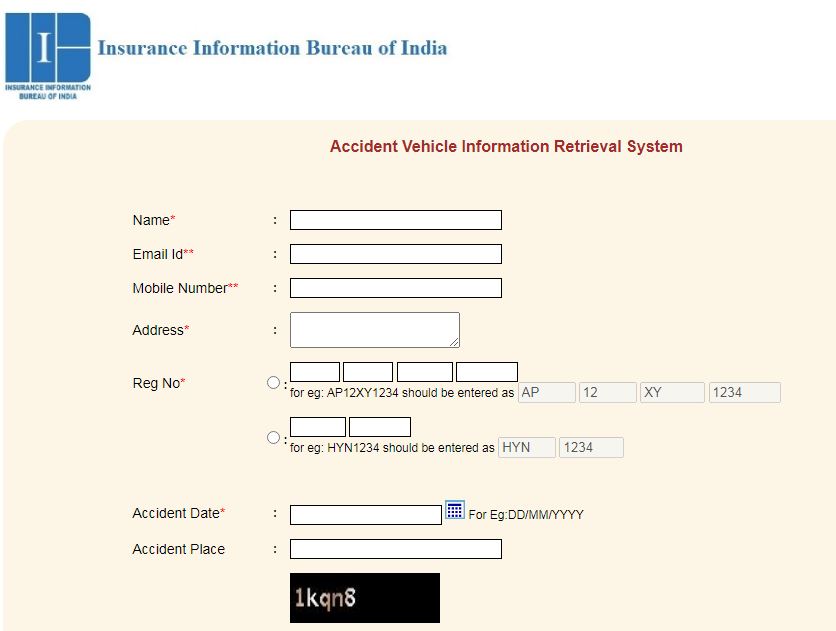

Keep all details like name, place of accident (if known), accident date, mobile number, email ID, vehicle registration number and address.

Login to the IIB web portal and enter all the needed information in the mandatory fields.

If you need help getting insurance details with the vehicle registration number, you can search for more information like vehicle engine digit or chassis number.

- Insurer’s website or mobile application

- Insurance Information Bureau (IIB)

- VAHAN – Ministry of Road Transport and Highways

- Parivahan Sewa

- RTO (Regional Transport Office)

Search Guidelines for Vehicle

When you utilise the IIB web portal to check vehicle insurance status online, make sure you follow the guidelines below:

- Ensure the vehicle registration number had entered without special characters, e.g. KA01MC5656. Also, a registration number is mandatory.

- After you have submitted the policy details to the data repository, it takes two months for the information to be available on the IIB web portal. Therefore, the vehicle details may not be visible in the database.

- Insurers submit only vehicle chassis and engine numbers in case of the new vehicle.

- The data is based on the details submitted by the insurer and is available for the database from 1 April 2010 onwards.

- If the details are unavailable, you can visit the concerned Regional Transport Office (RTO) for more information, including the owner, address, etc.

- A maximum of 3 searches are allowed for a particular mobile number or email address.

How to Check Vehicle Insurance Policy Status Online?

Checking car insurance status is very simple and easy to follow. The Insurance Regulatory and Development Authority of India (IRDAI) has launched an insurance data repository, the Insurance Information Bureau (IIB).

IIB is a web portal for tracking vehicle insurance policy information. Following are the steps to check car insurance status online:

Online Process:

- Visit IIB’s web portal.

- Enter required details like name, email ID or mobile number, address, car registration number, date of accident and security ‘Captcha’ code.

- Click on submit.

- Car-related insurance policy details are displayed; However, if it is not available, the previous policy details will appear.

- If you cannot retrieve any information through the above method, you can search by car engine and chassis number.

Things to note:

- Car insurance policy details in IIB are available for insurance policies from 1 April 2010 onwards.

- You should visit the relevant ones if you are still seeking insurance details.

- Insurance policies under two months old do not appear in the IIB database.

- For new cars, insurance suppliers submit only the engine and chassis numbers of the vehicle.

Offline Process:

To avoid checking your car insurance status online, you can find the details by checking with the concerned RTO. They can provide information. If your car is damaged and you need to claim for financial loss:

However, if you are met with an accident and want to know the car insurance policy details of the other car, you should contact the concerned RTO for more information.

How to Check Bike Insurance Status Online?

With the advent of the Internet, checking two-wheeler insurance statuses has become very easy and efficient.

You can find your bike insurance status online through Insurance Information Bureau (IIB) launched by IRDAI. Below is the procedure to check the status online as well as offline:

Online Process:

- Visit the IIB web portal.

- Enter details like name, email ID or mobile number, address, car registration number and date of the accident in mandatory fields.

- Enter the security digit and click on submit.

- The relevant two-wheeler insurance policy details will appear; However, if that doesn’t happen, the last policy details will occur.

- If you are still looking for details through the above method, you can search by engine and chassis number of the bike.

Offline Process:

If you want to check your two-wheeler insurance policy status offline, you can:

- Call your insurance company, and they can provide you with your bike insurance policy details.

- If you want to check the quality of the vehicle involved in an accident with your car:

- It would help if you visited the concerned RTO to get more information.

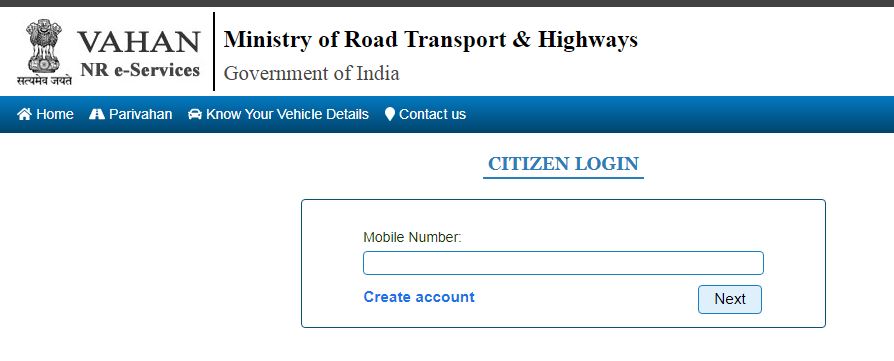

Another way to check your bike or car insurance status through Vahan e-Services is:

In case the Insurance mentioned above Information Bureau of India website (iib.gov.in) is not working, you can use the following alternative process to find the expiry period of your car or bike insurance status:

- Visit the official website of Vahan e-Services and click “Know Your Vehicle Details” from the top navigation.

- Enter the vehicle registration digit(number plate details) and the required.’

- Verification Code.

- Click on ‘Search Vehicle’.

- You can view the vehicle’s insurance expiry date and other car details.

Contact Details

Address: Insurance Information Bureau of India, 1st floor, APSFC Building, 38/39, Financial District, Nanakaramguda, Telangana 500032

FAQs

If you drive your vehicle, car or bike without a registration number, you will charge under Rule 50 of the Central Motor Vehicles Rules under Section 177 of the MV Act. Once the vehicle is registered and following the proper procedure to register your car, it is advisable to travel or drive it.

As the insurance policy had linked to the car or bike registration number, you need to provide the vehicle registration digit while renewing the policy. Also, through the number, you can easily track the insurance policy and renewal status associated with the vehicle.

You can renew a vehicle’s registration certificate after 15 years because it is valid for 15 years from the issue date.

Visit the IIB portal, the VAHAN website, and the insurance provider’s website from whom you purchased the policy. These are the three ways you can check.