PM Kisan Credit Card is a scheme initiated by the Government of India. This scheme allows farmers to borrow loans with low interest from banks. Credit Cards were introduced in 1998 by the Banks of India.

The institutes that give credit cards to farmers are commercial banks, regional rural banks, and state cooperative banks. An insurance facility for credit cardholders charges Rs 50,000 for death and permanent disability and Rs 25,000 for other risks.

Contents

Benefits of PM Kisan Credit Card

- Farmers with this Credit Card no need to apply for a loan for every crop

- For farmers, the interest burden is reduced by credit cards.

- Farmers can buy seeds and fertilisers of their choice at any time.

- Farmers can also get dealer discounts by using PM Kisan Credit Cards.

- With this PM Kisan, credit card farmers can get loans, and no one will refuse to give them.

- Every bank in India will give Kisan CreditCard loans to the farmers.

Eligibility

- All the farmers and tenant farmers are organic or associated with crop production and eligible for PM Kisan CreditCard.

- Farmers of single or joint borrowers are eligible.

- Farmers should be between 18 and 75 years old to apply for KCC. For farmers above 60 years of age, a co-applicant is mandatory.

- Self Help and Joint Liability group farmers are eligible to apply.

- Fishers and farmers involved in animal husbandry are also eligible.

Documents Required for Card:

- Aadhaar Card

- Pan Card

- Voter ID card/Passport/Driving License

- Any other government-approved photo ID

- Utility Bills as Address Proof

- Photographs

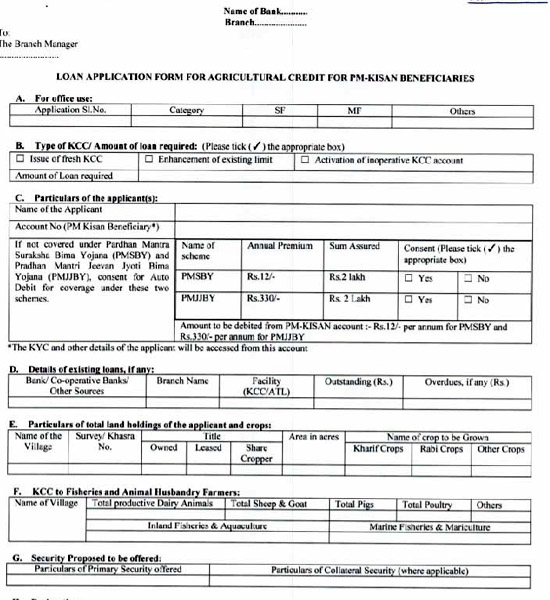

- Filled Application form

- Farmers must mortgage the land to banks if the loan amount is high.

Application Process for PM Kisan Credit Card

Step 1:

Farmers can apply by visiting the preferred bank websites like SBI, Axis Bank, Punjab National Bank, Indian Overseas Bank, Bank of India, HDFC Bank, etc.

Step 2:

After opening the website, search for “Apply KCC,” download the application form and take a printout.

Step 3:

Fill out the form completely with the required details.

Step 4:

After filling it out, submit the application form to the bank’s nearest branch.

Step 5:

The Loan Officer will review the application form and issue a reference number to the farmer in the bank.

Step 6:

Farmers have to save the reference number for future use.

Step 7:

After the loan is sanctioned, the KCC will dispatch it to the farmer.

PM Kisan Samman Nidhi

According to Budget 2020, the government took a significant step in making institutional credits more accessible to farmers.

The Indian government is merging the Credit Card with the Kisan Samman Nidhi scheme.

The beneficiaries of Kisan Samman Nidhi are also eligible for credit cards, for which the farmers avail loans of 4% for their farming.

Application process through PM Kisan Website

- Farmers can apply for the Kisan Credit Card by visiting the official website.

- On the home page, there is the “Download KCC form option,” click on that.

- The application form in PDF will appear, download and take a printout of the form.

- Fill out the application form with the required details.

- Submit the application form with all the required documents to the nearest bank.

- After submitting the form and completing all the formalities, the bank will issue a credit card to the farmer.

- The loan Application Online Form is below.

Kisan Credit Card Links for Application from Top Banks

- SBI Bank Application form

- Axis Bank Application

Due to COVID-19, the farmers can avail of a six-month moratorium. RBI announced that farmers could use 10% of the credit cash for household needs.

Finance Minister Nirmala Sitharaman announced a free credit of RS 2 Lakh Crores to benefit 2.5 crore farmers throughout India through KCC.

Kisan Credit Card Status check

- Visit the website and visit the CSC PM KCC Portal.

- Click ‘View Status’ after logging in to their portal by entering your CSC ID and password.

You must enter the KCC application ID. Kisan’s credit card Status will now appear on the screen.

Pm Kisan App

Download the app from the Play Store.

Helpline Numbers

- Toll-Free – 1800 115 526

Helpline Number – 0120-6025109/155261

Help desk Email – pmkisan-ict@gov.in - PM-Kisan Helpline No – 155261/011-24300606

FAQs

If you are eligible for the PM Kisan credit card, apply online or offline at your convenience. You can apply for this card online via the website of any bank that offers this product. Alternatively, you can visit the bank branch to apply for the card.

All farmers, individuals, and joint borrowers are owner cultivators. Tenant farmers, Oral lessees and Sharecroppers. SHGs or Joint Liability Groups of farmers, including tenant farmers, sharecroppers,

Visit the official site of any bank of your choice and the Credit Card Section. Download the application form and print it out. Fill out the application form. Visit the nearest bank branch and apply using the documents you requested.

Security: For KCC, the limits are up to Rs.1.60 Lakh. Hypothecation of Crops. For KCC limits up to Rs.3.00 Lakh (With tie-up arrangement): Hypothecation of Crops.

मी २६ मे २०२० ला किसान क्रेडीट कार्ड करिता अर्ज केला होता पण आज पावेतो काहीही रीप्लय आला नाही कार्ड पण आले नाही . CSC ID 761656170015

Application Ref No 132349601831425438

KISSAN CARD APPLY SIX MONTHS.CARD NOT DESPATCH

Applied for pm kisan credit card. File submitted in SBI br Andora tal.kallam Dist. Osmanabad(MS)

On 23/03/2021.Ii have not received any reply or card until 29/4/2021.

My Account NO.MH 241685397

Applied for pm kisan credit card. File submitted in CANARA BANK branch Chandragiri Mondal.Chittoor Dist. Andhra Pradesh

On 08/04/2021.Apply date have not received any reply or card until 12/6/2021.

My Account NO.5088101003239,IFSC CODE:CNRB0005088,Application Ref No:132623578431462847,CSC ID:477171530016,PM KISSAN ID:AP143189831.