It is known for its administration and client care. However, as the new government rules indicate, you must consistently keep a specific amount in the bank account. The base prerequisite for the Urban region is Rs. 5000, and for Rural Areas is Rs. 3000.

Assuming you will not be ready to keep up with the base record balance, the bank will punish you with a base amount maintenance charge.

Assuming you have numerous records in different banks, keeping the base record balance in all the bank accounts may not be easy.

The most effortless approach for removing the least amount of maintenance charges is by keeping up with adjusting or shutting your bank account.

The Account conclusion or closing process is quite simple. You need to follow a small procedure. Assuming you’re looking for how to Close the HDFC account, here is how you can do it.

Contents

Instructions to Close HDFC Bank Account Online :

Unfortunately, You can’t close the HDFC Bank Account Online. However, to close the HDFC account, you don’t have to visit the home branch.

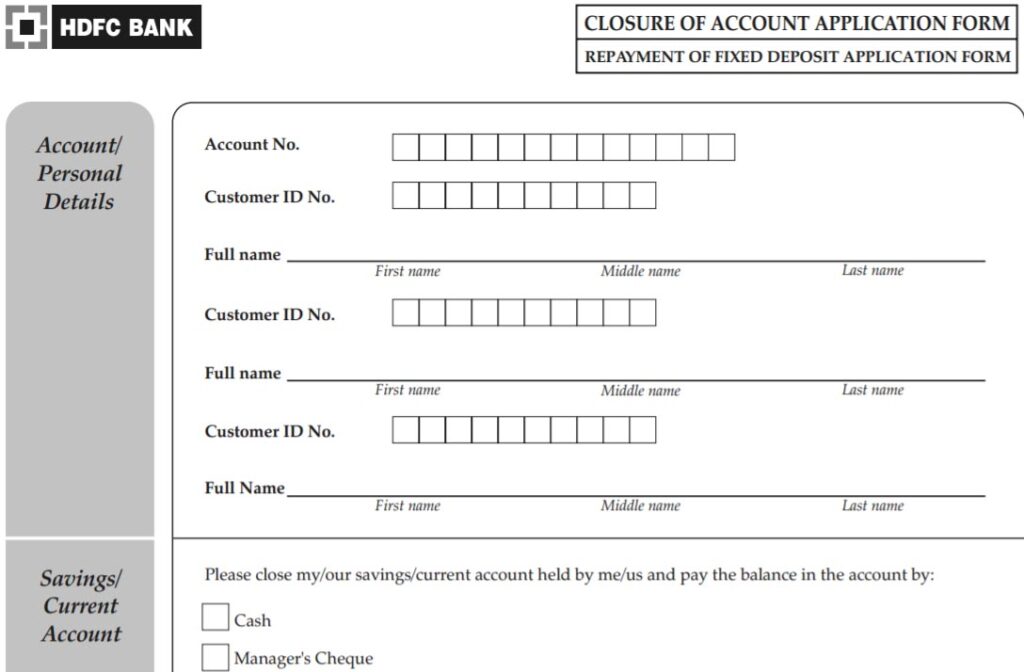

You can find the account closure form online, download it and visit the closest HDFC Bank office to close your HDFC Account on the web.

HDFC Regalia Credit Card | Features, Charges, and online Apply

Step-by-step process to Close HDFC Bank Account Permanently:

Before shutting your record, try to cash out the entire money from your bank account. You can move your cash to another record using UPI, NEFT, RTGS, or IMPS.

As soon as you clear all the amount present in the bank account. Visit your closest branch, get the account closure form, and fill in the form correctly with all the required details.

You can download the Account conclusion structure from the authority HDFC bank site and take a filled account closure form to the nearest branch. To download the HDFC Bank account closing form, click here.

Then, Submit the form to the bank manager alongside the Debit card, Passbook, and Checkbook. Try to carry ID Proof with you as the manager might ask for confirmation.

Soon after presenting the closing account form alongside different documents needed to close your bank account, the manager will give you a duplicate of the confirmation form. Your HDFC Bank record will be shut down within ten working days.

If you have issues with the account closing process, you can approach the 1800 22 1006 number for more assistance. The client care manager will address your entire inquiries related to the closing of your bank account.

HDFC BC Login Process | Kiosk banking services through CSC

Points to remember:

Before you submit the Account Closure Form to Your Branch, Here is a Checklist You Should Follow to be on the safer side.

- Open New Bank Account – The First thing You Need to Do Before You Close Your Bank Account is to Open a New Account in another Bank. You have once Opened a Deposit of all Your Cash.

- De-Link Your Debit card Auto Payment – It is Very Important to De-Link Your auto Payments from Your old Cards. Cancel all Your Insurance Payments and De- Link from the UPI-based apps.

- Statement Backup – Never know when you need your old bank statement. So it is very important to Take Backup up all Your Back statements. You can Take a Print out of the Statement a Keep it Safe.

FAQS:

As of now, you can not close your HDFC account online. You can download the closing account form from the HDFC site and visit the branch to close your account.

No charges will be taken if the account is shut in 14 days or a year before opening. If the record is shut after 15 days and within a year of opening, a charge of Rs.500 will be taken (Rs 300/ – for Senior Citizens).

If you are not ready to keep up with the base equilibrium in your record, you will be punished for a punishment expense.

The Penalty expense thoroughly relies upon the record types and region.

You can close your account whenever you need. But if you close the record between 15 days and a year of opening, a charge of Rs. Five hundred will be imposed.

HDFC bank zero bank account can be opened by any person with no living account in the bank and doesn’t have total KYC.

A Zero Balance Savings Account Can be opened in HDFC Bank. However, you have certain value-based and functional cutoff points.

we have close my saving account

too many account am having