Individuals willing to withdraw the PF amount must note that withdrawal happens partially and fully. Similarly, you can choose to remove the amount offline or online mode.

Contents

- 1 Withdraw the PF amount.

- 1.0.1 Different ways to withdraw the PF amount

- 1.0.2 How to withdraw EPF offline?

- 1.0.3 How to Withdraw the PF amount online?

- 1.0.4 When can EPF be withdrawn?

- 1.0.5 How long does it take to Withdraw the PF amount?

- 1.0.6 How many times can you Withdraw the PF amount?

- 1.0.7 What is Withdraw the PF amount Process for a Deceased person?

- 1.0.8 How to check the PF amount status?

- 1.0.9 What are the EPF tax rules?

- 1.0.10 FAQs

Withdraw the PF amount.

Partial EPF withdrawal can do under certain circumstances. Complete withdrawal is allowed for individuals or individuals who retire with two months of unemployment. If you withdraw EPF under any such cases, read on to learn everything about it.

Different ways to withdraw the PF amount

As mentioned in the introductory paragraph, you can do EPF offline and online. So, let’s discuss the processes separately. There are two ways to withdraw the PF amount.

How to withdraw EPF offline?

The offline process of Withdraw the PF amount had discussed below.

- Download Composite Claim Form (Aadhaar or Non-Aadhaar).

- After downloading, read the guidelines to withdraw the PF amount.

- Individuals applying through Composite Claim Form (Aadhaar) need to link their Aadhaar number with their primary bank account number (called Aadhaar seeding) and provide bank account details.

- Further, it needs an activation process through the portal.

- On the other hand, people applying with Composite Claim Form (Non-Aadhaar) can skip going through Aadhaar seeding process to withdraw EPF.

- After individuals fill in the data, they must submit the form to the concerned jurisdictional Employees’ Provident Fund Organisation office. Here, the owner’s confirmation is also required.

How to Withdraw the PF amount online?

The online process for Withdraw the PF amount had mentioned below.

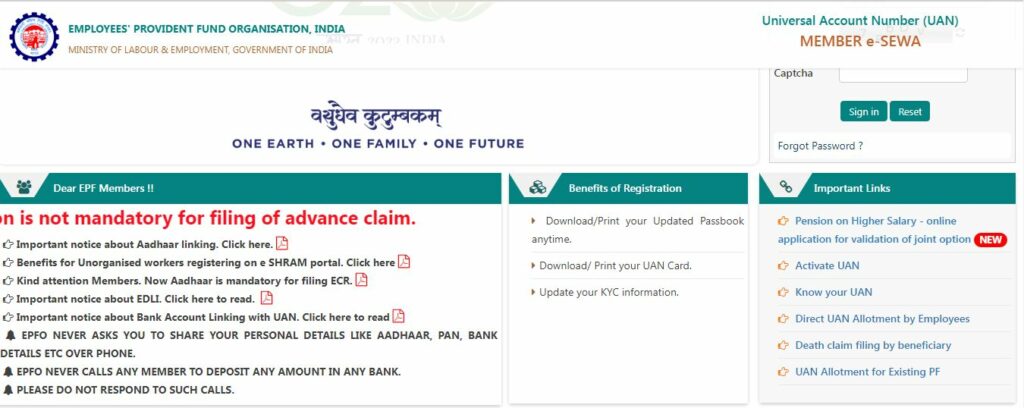

- Visit the Member e-Service Portal on EPFO Portal.

- Sign in to your account with a pswd, UAN and Captcha.

- choose ‘Claim (Form-19, 31, 10C & 10D)’ from the ‘Online Services tab.

- A new webpage will open where you must provide the correct bank account number linked to the UAN.

- Click on Verify.

- After verifying the bank account details, you must confirm the terms and conditions of the Employees’ Provident Fund Organisation.

- Select ‘Proceed for Online Claim’.

- Here, you must select the reasons for withdrawing from the drop-down list.

- Remember, the given list shows the options based on your eligibility.

- Once people select withdrawal or advance reasons, they must provide their address.

- Please note that persons claiming advance must specify the amount and upload a scanned copy of the required documents (per Employees’ Provident Fund Organisation instructions).

- Click on Terms and Conditions.

- Select ‘Get Aadhaar OTP’.

- An OTP will send to your registered mobile number. Insert the OTP in the corresponding box.

- After successfully entering OTP, an online claim to Withdraw the PF amount is submitted.

To Withdraw the PF amount online, individuals need to activate UAN and link it with KYC, i.e. Aadhaar, PAN and bank details. Once all the conditions had fulfilled, individuals can easily claim for EPF withdrawal. The online process is easy for Withdraw the PF amount.

When can EPF be withdrawn?

Withdrawing the PF amount is allowed under different conditions, and each state has other eligibility parameters. Read on to know this additional EPF withdrawal eligibility.

Retirement: Individuals who retire from employment at 55 years are eligible to Withdraw the PF amount.

Unemployment: Individuals who are unemployed for two months can withdraw 75 per cent of the total EPF amount.

Medical benefit: When EPF had withdrawn for medical purposes, there was no minimum service year requirement for the claim process.

Marriage: To Withdraw the PF amount for marriage purposes, individuals should have at least seven years of service life.

Repayment for Home Loan: Individuals withdrawing EPF must complete three years of service life to repay home loans.

Purchase or Construction of House: Eligible for EPF withdrawal in case of expense or construction of the house, the concerned person must have completed five years of service.

Home Renovation or Renovation: EPF withdrawals for home renovation or renovation must have five years of service life.

How long does it take to Withdraw the PF amount?

The time taken to clear the claims from the pension body depends on the withdrawal application procedure. These had mentioned below –

- Applying for EPF withdrawal online may take up to 3 working days.

- On the other hand, applications for offline EPF withdrawal may take up to 20 days to process.

How many times can you Withdraw the PF amount?

Early EPF withdrawals are permitted under certain circumstances and are subject to certain limitations. These had discussed below,

- Individuals willing to Withdraw the PF amount for marital purposes can do so only three times.

- Individuals withdrawing EPF to buy a plot or house or to construct a home can apply for a one-time EPF advance claim.

- In medical emergencies (before retirement), there is no strict limit for withdrawal.

- You can make Withdraw the PF amount (advance) for funding post-matriculation education three times.

What is Withdraw the PF amount Process for a Deceased person?

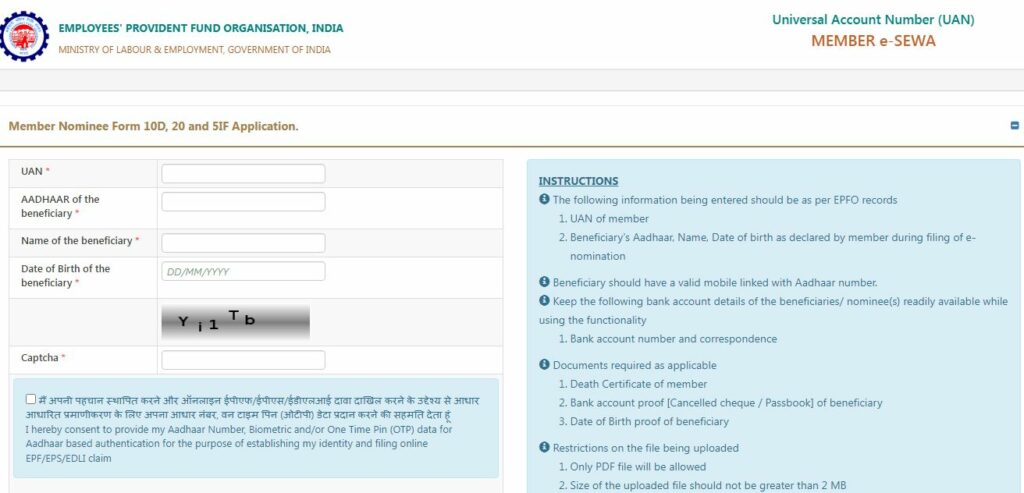

Suppose a person dies during their service life. In that case, the nominee can claim the money Employees’ Deposit Linked Insurance Scheme (EDLI), Employees’ Provident Fund (EPF), & Employees’ Pension Scheme (EPS) accounts of the deceased. Here, the beneficiary should follow these steps.

- Visit the official website EPF portal.

- Select the link ‘Death Claim Filing by Beneficiary’. It is in the right corner.

- The nominee has to enter specific details like Universal Account Number (UAN), Beneficiary Name, Beneficiary Date of Birth, Beneficiary Aadhaar and Captcha Code.

- They have to click on ‘Authorize PIN’.

- An OTP will send to the beneficiary’s registered mobile number (linked with Aadhaar). The beneficiary has to submit the OTP and can file the death claim with EPFO.

By following the process mentioned above, the beneficiary can claim EPF after the death of the salaried person.

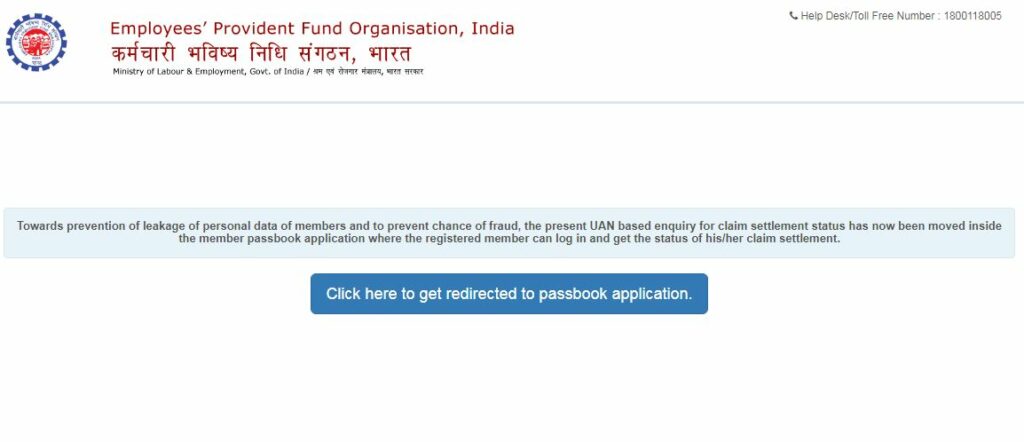

How to check the PF amount status?

Once a person has requested Withdraw the PF amount, they can check its status online. Follow the steps mentioned below to narrow the EPF withdrawal status.

- Visit the EPFO portal.

- Click the ‘Our Services’ tab and select ‘For Employees’ from the drop-down list.

- Click on ‘Know Your Claim Status’.

- Provide your UAN.

- Enter the Captcha Code.

- Provide details including PF office status, concerned PF office, establishment code, and provident fund number.

- Click on ‘Submit’ and check the EPF withdrawal status.

From the above write-up, individuals can get a comprehensive guide on EPF withdrawal. Read the steps carefully and note the essential details, and you can withdraw EPF without hassle.

What are the EPF tax rules?

EPF is the EEE tax rule. So, it is exempt from tax on EPF withdrawal. Further, donations and interest received are also exempt from tax. And there are some cases where EPF is taxed. You have follow the EPF tax rules to withdraw the PF amount. These are:

- Employer’s contribution to employees’ provident fund in a financial year is taxable if it exceeds ₹7.5 lakhs.

- An employee must pay tax on an amount exceeding ₹7.5 lakhs.

- If the excess contribution from the employee to the EPF account in a financial year exceeds ₹2.5 lakhs, the interest earned on this extra amount is taxed.

- If there is no employer contribution to the EPF account for government employees, the interest is tax deductible up to ₹ five lakhs in a financial year.

- Interest earned on inactive PF accounts is taxable in the hands of employees.

- Withdrawal from Employee Provident Fund Account is tax-exempt except when It has made the retreat after less than five years of continuous service.

- If any withdrawal amount exceeds RS 50,000, then TDS is applicable at 10%. However, Withdrawing the PF amount is exempt in the event of the employee’s ill health, the closing of the business, or other events beyond the individual’s control.

FAQs

PF account holders can withdraw up to 50% of the total employee contribution to EPF to pay for their higher education or to meet the educational expenses of their children after class 10. Funds had transferred after at least seven years of contribution to the EPF account.

You can withdraw a 100 per cent EPF balance only after your retirement.

No, an individual does not need the employer’s permission for EPF withdrawal.

No, individuals cannot withdraw their PF balance while working. However, certain circumstances allow partial EPF withdrawal.