This article provided information regarding the Solvency Certificate format, application form, issues solvency, and application procedure of solvency certificate.

Contents

What is Solvency Certificate?

Solvency is a certificate in which we get information on the financial stability of an entity/individual. It is given by the government and commercial officers, ensuring that the financial credibility of individuals/entities is required. It is a legal document to support the financial strength of every individual/entity.

Need for the solvency certificate.

- Visa Interviews

- To apply for tenders

- Legal matters

- To obtain contracts

Eligibility Criteria

These are the eligibilities

- An Individual who is a citizen of India.

- An individual who is a permanent resident of Delhi

- Having property within the territorial jurisdiction of NCT of Delhi.

Documents Required

- Identity proof

- Address proof

- Application forms issued by banks

- Bank savings

- Financial statements

- Income Tax returns

- Property documents

- Net Worth Certificate (Issued by Chartered Accountant)

- Additional Investment certificate

- Gold Validation certificate

Solvency Certificate Application Fee

The fee charged for receiving the certificate is different from bank to bank. Most of the banks charge nearly Rs 2000 to issue.

Who Issues Solvency?

Banks issue solvency certificates, revenue departments, or other financial institutions upon request. The most commonly accepted certificates are from banks.

It will have a validity period of one year, and we need to renew it every year to ensure that the certificate is accepted in all cases.

Application Procedure of Solvency Certificate

The applicants who have and maintain a savings/current bank account in banks can apply and submit the certificate. To prepare the certificate, banks will rely on various documents and information.

So before the application procedure for the certificate, the applicants must also submit the following documents:

- Property Valuation

- Gold Valuation

- Bank Statement

- If any, a fixed deposit receipt

- If any, Provident & Mutual Fund statements/shares

- Net worth certificate from the Chartered Accountant

Now submit the application form with all the above documents and photocopies attached by bank officials. Carry the original documents while submitting the form with photocopies for verification purposes.

After submitting the application form and required documents, the bank will process the application form on weekdays and solve Solvency issues. The processing time to get the certificate is 15 days after applying.

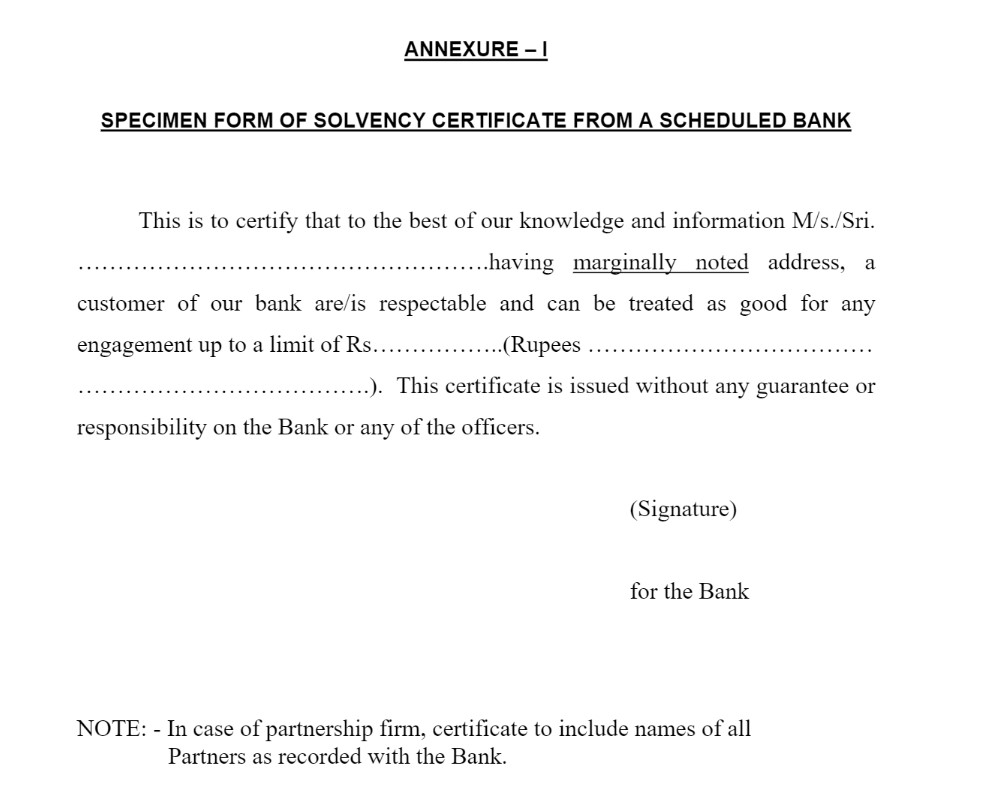

Solvency Certificate Format

Below is the Solvency Certificate format

To Be Issued on a Bank’s Letterhead

Format of Sample Solvency Certificate

Following is the format of the certificate. Download Certificate PDF

Date:

- Private and Confidential

- To the concerned Authority

- Address of the Authority

- A/c to (Organisation name)

- Reference no.

We, (Name of the bank), at this moment, certify that (Name of business), having their registered office at (Registered office address), is solvent to the extent of INR 25,00,000/- (INR 25 Lakh only) as disclosed to us on (date) with the financial records shared with us.

It should also be noted that this certificate is issued at the request of (Name of individual requesting certificate) without attaching any responsibility or risk on our part in any respect whatsoever, either as a guarantor or otherwise.

- For (Name of the Bank)

- Signature and Stamp of Bank Manager

Why is a Solvency Certificate Required?

- For government and legal purposes

- Solvency certificate for tenders

- For Visa applications and interviews

- Getting Government and private contracts

In some states, one might also require it for getting admission to medical and engineering colleges.

Conclusion

A solvency certificate is a document that details an individual or entity’s financial soundness and solvency. When interacting with government and commercial offices, this is usually a prerequisite since they need to know the financial position of the individuals or entities.

FAQs

It is a document that provides information about the financial stability of an individual/entity.

Banks, financial institutions, and the State’s revenue department can issue this certificate. Banks issue this certificate only to their customers based on a few parameters, such as transaction details, account information, and property-related documents available to them.

It is proof of financial health when an individual or organization cannot satisfy its debts. It is a crucial financial document that certifies an individual’s or entity’s fiscal strength.

It is calculated by dividing the company’s total debt by its total capital, i.e., equity and debt capital combined.

Interest Coverage = (Earnings Before Interest & Taxes)/Interest Expense.

Fixed Charge Coverage = (EBIT + Lease Payments)/(Interest Payments + Lease Payments)