The Government of India has started a program called Startup India Scheme to reduce the financial burden on startup companies and reduce compliance costs while increasing profitability. Entrepreneurs introduced this plan to grow their businesses.

Contents

What is Startup India Scheme?

Launched on 16th Jan 2016, the Startup India scheme has put forward several initiatives to encourage entrepreneurs, establish a robust entrepreneurial ecosystem and make India a hub for job creators.

These projects had monitored by the Department of Industrial Policy and Promotion (DPIIT). The plan focuses on strengthening startups from major cities and empowering people from small towns who want to be business owners.

Benefits of the Startup India Scheme

The Startup India scheme offers a variety of benefits to startups. However, to avail of these benefits, the company needs to be recognised as a startup by the Department of Industrial Policy and Promotion (DPIIT).

The benefits of the Startup India scheme are as follows:

Discount on patent cost:

In India, most startups are patent based, i.e. they offer unique goods or services. While registering with any private company, they have to pay a high fee to register their companies, which is also known as patent cost. But under this initiative, the government provides 80% repayment on patent costs.

Tax Exemption:

Eligible startups are exempt from paying income tax for the first three years after incorporation. However, to avail of this benefit, the company must be recognised by DPIIT.

Easy Registration Process:

The Startup India registration process is simple and free, and easy. Everything happens in one meeting. Moreover, dedicated officers are eager to help you every step of the way.

Startup India Scheme Government Contracts:

Due to high payments and big projects, everyone likes getting their hands on government contracts. However, getting government tenders takes work. Under this scheme, startups are given priority in government tenders.

Self-certification:

The scheme enables startups to self-certify compliance with six employees and three environmental laws. There will be no examinations for employment law for five years.

Networking opportunities:

The plan enables entrepreneurs to meet stakeholders worldwide by organising yearly startup carnivals. It helps develop a large global network that is profitable for the company.

Apart from the above benefits, you will also get benefits like efficient compliance, a smooth exit mechanism for flawed startups, legal aid, patent application tracking and a website to curb unofficial information distribution under the Startup India program.

Government Measures to promote startup culture in India

As a bit of the “Make in India” initiative, the government proposes to organise a startup fest annually at the national level to enable all stakeholders in the startup ecosystem to come together on one platform. Details about the Make in India program can find on the linked page.

Launch of Atal Innovation Mission AIM-To promotes entrepreneurship via Self-Employment and Talent Utilization (SETU), wherein innovators had supported and mentored to become a successful business person. It also provides a platform for generating innovative ideas. The Atal Innovation Mission AIM details are available on the linked page.

Incubator set up through PPP – To ensure professional management of government-sponsored or funded incubators, the government will formulate a policy and framework for establishing incubators nationwide in public-private partnerships. The incubator had managed and operated by the private sector.

The Startup India Seed Fund Scheme took effect on 1st Apr 2021. The scheme aims to supply startups with financial assistance for prototype development, proof of concept, product trials, market entry and commercialisation.

Eligibility for Startup India Scheme registration

Registration as a startup is allowed only for businesses listed below:

- Partnership Firms

- Limited Liability Partnership Firms

- Private limited companies

The following are the eligibility for registering your company under this Startup India Scheme:

- The Department of Industrial Policy and Promotion (DPIIT) should license the business.

- The company should not be more than five years old

- The annual turnover value is Rs. Do not exceed. 25 crores

- It must include a reference letter from the startup incubator.

- It must offer unique products and services.

- Employment generation should be encouraged.

- It should not be the result of the termination of an existing business.

Startup India Scheme Registration Process

Startup India Scheme registration charges with professional utilities are Rs. 7,499, and the process takes 15-20 working days to complete.

Here are the easy steps to follow for Startup India Scheme registration:

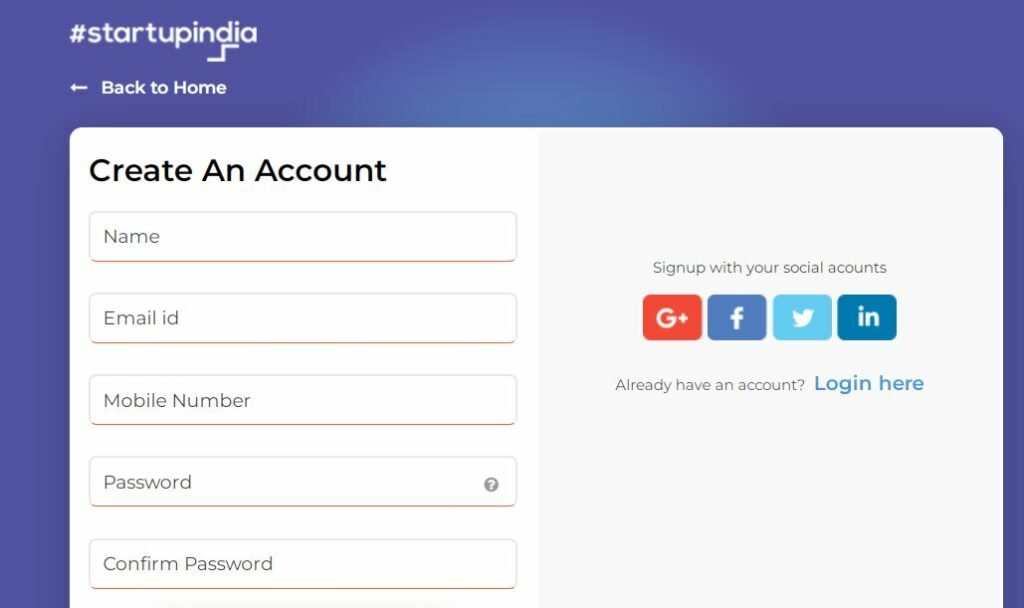

- Go to the Startup India Scheme signup page.

- Enter your details, including your email address, mobile number and desired password. Next, verify your email through OTP.

- Now you can sign in using your login credentials.

- It will direct you to a hub where you can select and create a stakeholder profile that best defines your role.

- After creating a profile, the next step is to apply for Department Promotion for Industry and Internal Trade (DPIIT) recognition to get benefits as a startup.

- Log in to your Startup account and click “DPIIT Recognition for Startups” under the “Schemes and Procedures” tab.

- On the next page, link to the “Get ID” button, leading you to another page.

- Next, link to the “DPIIT Recognition for Startups” button in the “Schemes and Procedures” tab at the bottom of the page.

- A form will open where all fields are compulsory. You need to fill in details like your Startup, nature of business, PAN number, year of establishment, office address, partner details etc.

- You must also upload relevant documents like a registration certificate, pan card, trademark details, funding documents, pitch etc. Deck, etc

- After completing the form and uploading the documents, agree to the terms and click “Submit.”

- You will receive a unique identification number for your start.

- If all the uploaded documents are verified, and no error had found, you will receive the identity certificate from DPIIT within two days.

Startup India Scheme Conclusion

It is a great time to start a company in India as the government is very gungy about foreign investment and employment these companies bring.

As the government assists with the Startup India initiative, startups should grab the opportunity and register themselves.

FAQs

You will accept your Startup India certificate after verifying the details provided by you along with the application form.

Seed funding for startups had provided through state/centre-recognised incubators.

Partnership Firms, Limited Liability Partnership Enterprises and Private Limited Companies are eligible for Startup India.

Private limited companies and limited responsibility partnerships are eligible for tax exemption under section 80IAC.