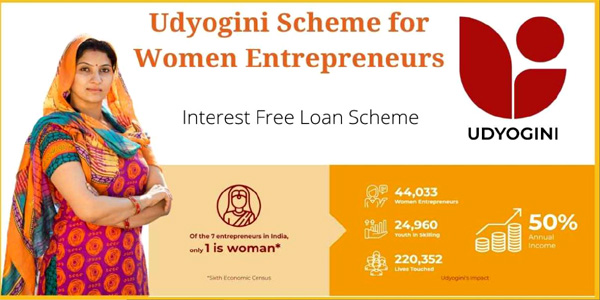

The Udyogini Scheme is a government initiative to empower women entrepreneurs by offering financial assistance, subsidized interest rates, and resources to start or expand their businesses.

It is vital in promoting women’s economic independence and fostering entrepreneurship for sustainable socio-economic development.

| Scheme Name | Udyogini Scheme |

| Introduced by | Women and Government entrepreneurs in India |

| Implemented by | Government of India’s Women Development |

| Interest Rate | Subsidized, Competitive, or free for special cases |

| Yearly Family Income | Rs 1.5 lakh or less |

| Loan Amount | Max. up to Rs 3 lakhs |

| No income limit | For Disabled women or Widowed |

| Collateral | Not required |

| Processing Fee | Nil |

Contents

- 1 What is the Udyogini Scheme?

- 1.0.1 Udyogini Scheme for Women 2023:

- 1.0.2 Objectives Udyogini Scheme:

- 1.0.3 Udyogini Scheme Benefits:

- 1.0.4 Features of the Udyogini Scheme:

- 1.0.5 Supported Businesses under Udyogini Scheme:

- 1.0.6 Eligibility Criteria for Getting a Loan Under the Udyogini Scheme:

- 1.0.7 Documents Required:

- 1.0.8 How to Apply for a Loan Under the Udyogini Scheme?

- 1.0.9 Help Desk:

- 1.0.10 Conclusion:

- 1.0.11 FAQs:

- 1.0.12 Related Posts:

What is the Udyogini Scheme?

The Women Development Corporation has launched the Udyogini Scheme under the Government of India. The yojana aims to assist women financially to develop their businesses and enterprises. It will, in turn, also help the country’s overall economy.

As we know, there is a lot of untapped potential for women living in rural areas, but they need more resources and opportunities. The Udyogini Scheme focuses on building that bridge between women and economic development.

Udyogini Scheme for Women 2023:

The Udyogini Scheme for Women 2023 is a government initiative to empower women entrepreneurs by providing financial assistance, training, and support for starting or expanding their businesses.

Objectives Udyogini Scheme:

The objectives of the Scheme are:

- To promote and encourage the business-women of our country.

- To make women self-dependent by helping them by setting up their businesses.

- EDP training will provide to upskill their skills.

Udyogini Scheme Benefits:

The biggest benefit of this Scheme is it allows women empowerment. You can become an owner of your own business.

- Till now, this Scheme supported 7047 women entrepreneurs.

- Under this Scheme, 5432 children get support.

- More than 1698 villages had covered under his Scheme till now.

- Till today more than 53762 producers are engaged under the Udyogini scheme.

Some other benefits of this Scheme had given below:

- It motivates and assists women from backward areas to become entrepreneurs.

- Women from poor and illiterate backgrounds get support from this Scheme.

- This Scheme makes women financially independent.

- This Scheme also provides skill training that helps women with their businesses.

- This Scheme helps in women’s development and increases women’s empowerment.

Features of the Udyogini Scheme:

Udyogini is especially applicable to women in the lower classes of society. Following are some of the features which make this Scheme unique:

- Under this Scheme, eligible women entrepreneurs can avail of high-value, interest-free loan amounts of up to Rs. 3 lahks.

- This Scheme also extends a 30% subsidy on loans availed by women entrepreneurs.

- Women also participate in essential skill development programs for planning, pricing, costing, vitality, and financial knowledge.

- The evaluation and application process for Scheme is transparent and simple, ensuring that beneficiaries easily understand it.

- Under Udyogini, there are 88 small-scale industries which further broaden the scope for women entrepreneurs.

Supported Businesses under Udyogini Scheme:

Supported Businesses List under the Scheme is given in the table below:

| Leaf Cups Manufacturing | Diagnostic Lab | Agarbatti Manufacturing | Ribbon Making |

| Milk Booth | Edible Oil Shop | Bangles | Shops & Establishments |

| Audio & Video Cassette Parlour | Sari & Embroidery Works | Library | Dry Cleaning |

| Mat Weaving | Dry Fish Trade | Security Service | Bakeries |

| Banana Tender Leaf | Shikakai Powder Manufacturing | Match Box Manufacturing | Eat-Outs |

| Soap Oil, Soap Powder & Detergent Cake Manufacturing | Old Paper Marts | Fish Stalls | Bottle Cap Manufacturing |

| Silk Thread Manufacturing | Energy Food | Mutton Stalls | Beauty Parlour |

| Bedsheet & Towel Manufacturing | Silk Weaving | Gift Articles | Fair-Price Shop |

| Flour Mills | Nylon Button Manufacturing | Fax Paper Manufacturing | Silk Worm Rearing |

| Cleaning Powder | Newspaper, Weekly & Monthly Magazine Vending | Photo Studio | Tea Stall |

| Cane & Bamboo Articles Manufacturing | Stationery Shop | Pan & Cigarette Shop | Book Binding And Note Books Manufacturing |

| Canteen & Catering | Vegetable & Fruit Vending | STD Booths | Pan Leaf or Chewing Leaf Shop |

| Sweets Shop | Radio & TV Servicing Stations | Papad Making | Chalk Crayon Manufacturing |

| Ink Manufacture | Chappal Manufacturing | Cotton Thread Manufacturing | Flower Shops |

| Phenyl & Naphthalene Ball Manufacturing | Fuel Wood | Footwear Manufacturing | Tailoring |

| Tutorials | Gym Centre | Plastic Articles Trade | Tender Coconut |

| Household Articles Retail | Pottery | Handicrafts Manufacturing | Ice Cream Parlour |

| Condiments | Coffee & Tea Powder | Printing & Dyeing of Clothes | Clinic |

| Corrugated Box Manufacturing | Travel Agency | Quilt & Bed Manufacturing | Typing Institute |

| Dairy & Poultry Related Trade | Real Estate Agency | Jute Carpet Manufacturing | Creche |

| Woollen Garments Manufacturing | Ragi Powder Shop | Jam, Jelly & Pickles Manufacturing | Vermicelli Manufacturing |

| Readymade Garments Trade | Job Typing & Photocopying Service | Cut Piece Cloth Trade | Wet Grinding |

Eligibility Criteria for Getting a Loan Under the Udyogini Scheme:

Although getting a loan from this Scheme is simple, you must fulfill some criteria for its approval. The eligibility criteria and terms that you need to follow to get a Udyogini loan had below:

- Applicant must be a woman.

- Applicant’s businesses must register under the Udyogini scheme.

- Your age must be between 18 years to 55 years.

- The applicant’s family annual income must not exceed ₹1,50,000.

- The applicant’s required loan amount must not exceed ₹3,00,000.

- There is no need for any security against the Udyogini loan.

- There is no annual family income and age limit for disabled or widowed women.

Documents Required:

Some of the documents required for the Udyogini scheme are as follows:

- Duly filled Application Form with passport-sized photographs

- Applicant’s Aadhaar Card, Birth Certificate

- Applicant’s Below Poverty Line (BPL) card

- Ration Card

- Address and Income Proof

- Caste Certificate

- Bank passbook Xerox

- Any other document required by the bank/NBFC

How to Apply for a Loan Under the Udyogini Scheme?

This Scheme provides interest-free loans to women without any discrimination. You can receive the application for a loan from the Corporation branch of any district.

The steps that need to follow to apply for a Udyogini loan had given below:

Step 1:

Visit the concerned bank with all the necessary documentation. Take the application form.

Step 2:

Fill out the form thoroughly by entering all the necessary details.

Step 3:

Attach a photocopy of all the documents mentioned in the form.

Step 4:

Submit your business loan form to the bank.

Step 5:

After applying, you must visit the bank regularly for loan approval.

Help Desk:

- Udyogini Scheme: Official Website

- Email: mail@udyogini.org

- Contact Number: +91-9319620533

Conclusion:

The Udyogini scheme is a great initiative by the Government of India to empower women entrepreneurs. It provides financial assistance and skill training to women who want to start their businesses.

This Scheme can help women overcome the obstacles of capital generation and wealth creation. It can also help women make a living by themselves and showcase their abilities to the world.

FAQs:

The Scheme is a government initiative providing financial assistance and support to women entrepreneurs to start or expand their businesses.

Applicant’s businesses must register under the Scheme. Your age must be between 18 years to 55 years. The applicant’s family annual income must not exceed ₹1,50,000. The applicant’s required loan amount must not exceed ₹3,00,000.

The Government of India, under the Women Development Corporation, has launched a scheme for Indian Women entrepreneurs. The Scheme encourages poor women with financial assistance to start their businesses.

The Scheme relies heavily on the support of numerous commercial and public sector banks, including Sind and Punjab Bank, Saraswat Bank, and the Karnataka State Women’s Development Corporation (KSWDC).

Udyogini came into existence in 1992 and entered the micro-enterprise domain through the &lsquo Women s Enterprise Management Training Outreach Program’ (WEMTOP), which was initiated and funded by the World Bank Institute.

Started in 1997-1998 (and amended in 2004-2005), Udyogini is an innovative scheme sanctioned by the Government of Karnataka to assist women in gaining self-reliance and independence through self-employment, mainly through trade and the service sector.