Edwin Hardin Sutherland, the most influential criminologist and sociologist of the 20th century, first defined white-collar crime in 1939 as “crimes committed by persons of high social status, great reputation, and respectability in their profession.”

Contents

What is White-collar Crime?

White-collar crime is a non-violent offence where the primary motive is usually financial. White-collar criminals typically occupy a professional position of power and prestige and are well above average compensation.

The term “white-collar crime” had coined by sociologist and criminologist Edwin Sutherland in the 1930s. He used the phrase to describe the crimes usually committed by “persons of respectability” – people of high social status. Sutherland eventually established the Bloomington School of Criminology at Indiana State University.

Before Sutherland developed the concept of white-collar crime, the upper classes of society had been considered largely incapable of appealing to such criminal activity.

Such a belief had so deeply ingrained in society that when Sutherland first issued a book on the subject, some of the USA’s largest companies successfully sued to have the book heavily censored.

Types of white collar crime

White-collar crimes include a wide variety of crimes, including the following:

1. Fraud:

Fraud is a broad phrase that includes many different schemes used to defraud people of money. One of the most common and simple is an offer to send more money (say, $300 – the fraudster may refer to the small amount as a processing or finder’s fee) if someone sends a small amount (say, $10,000) to the scammer.

The fraudster gets the money sent to him but has yet to send the money he promised to send.

2. Insider Trading:

Insider trading is trading to have traders possess material, non-public information that gives them an advantage in the financial markets. For example, an employee of an investment bank may know that Company X is preparing to acquire Company.

An employee may purchase stock in Company B with the expectation that the Company’s stock price will increase significantly once the purchase becomes public knowledge.

3. The Ponzi scheme:

Named after Charles Ponzi, the real perpetrator of such a yojna, a Ponzi scheme is an investment scam that promises high returns to investors. It pays such returns to the initial traders with the newly deposited funds of the new investors.

When the scammer could not attract enough new clients to settle off the old ones, the scheme collapsed like a house of cards, leaving many investors with huge losses. it is a type of White-collar crime

4. Identity Theft and Other Cyber Crimes:

Identity theft and computer structure “hacking” are two of the most widespread crimes. In 2019, identity theft had estimated to cost nearly $2 billion in the United States alone.

With more than 73,000 identity theft cases, California is the state whose citizens have suffered the most from crime — followed by Florida, with 37,000 cases.

5. Abduction:

Embezzlement is a crime of theft or robbery that can range from taking a few dollars from an employee’s cash drawer to a complex scheme to transfer millions from company accounts to embezzler accounts.

6. Forgery:

Our money became more colourful and expanded in detail to combat counterfeiting. With today’s computers and advanced laser printers, it is very easy to copy old currency. But it needs to be seen how far the government’s efforts have been successful in this regard. High-quality copies of the new $100 bill are rumoured to be available within 24 hours of the new bill issue.

7. Money Laundering:

Money laundering is essential for criminals dealing with large amounts of cash. It funnels the cash through several accounts and eventually into legitimate businesses. It gets mixed up with the real earnings of the legitimate business and cannot identify as having come from the commission of a crime.

8. Espionage:

Spying, or espionage, is usually a white-collar crime; for example, Apple Inc. A foreign government agent seeking a piece of technology might approach a worker at Apple and offer to pay $10,000 if they provide a copy of the technology they want.

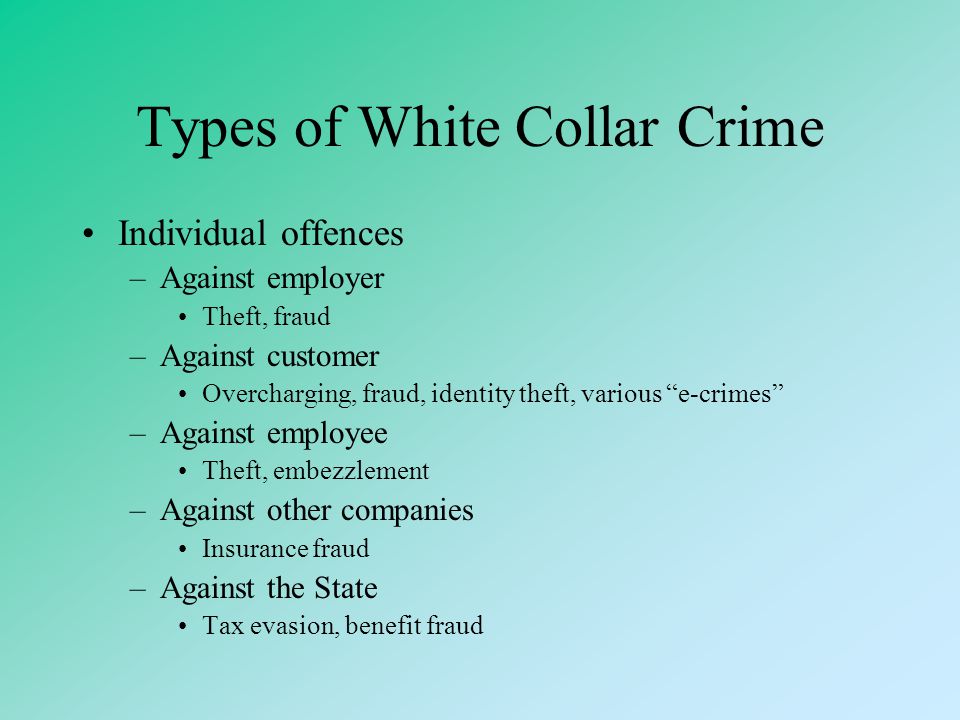

Classification of white-collar crimes

White-collar crime had generally divided into two broad general categories:

1. Personal offences:

Individual crimes had financial crimes performed by an individual or group of individuals. For example, an individual white-collar crime is the Ponzi scheme run by Bernie Madoff. Other personal crimes in this category include identity theft, hacking, counterfeiting, and dozens of fraudulent schemes.

2. Corporate Offenses:

Some white-collar crime commits at the corporate level. For example, a brokerage firm may involve its trading desk employees in an insider trading scheme. Money laundering can also carry out at the corporate level.

Conclusion

White-collar crime can have serious consequences for individuals, organizations and society. The Enron scandal, Bernie Madoff’s Ponzi scheme, the WorldCom accounting fraud, and the Volkswagen emissions scandal are examples of how white-collar crime can negatively impact the economy, the environment, and public health.

These cases also illustrate the need for more regulation, oversight, transparency and accountability in corporate practices. As a person, we can do our part by informing consumers and investors and by demanding greater accountability and transparency from the companies we do business with.

As a society, we can work towards more regulation and oversight to prevent future incidents of white-collar crime and hold those who engage in such practices accountable for their actions.

FAQs

It is punishable under Sections 403, 405, 415 etc., of the Indian Penal Code, 1860. Tax Evasion – An offence in which a person alters his affairs to avoid the application of tax. A company, individual or trust can do it, and it is punishable under the Income Tax Act of 1961.

The Serious Fraud Investigation Office (SFIO) had an agency established under the Ministry of Corporate Affairs (MCA) for investigating and prosecuting white-collar crimes. The SFIO had constituted in July 2003 following the recommendations of the Naresh Chandra Committee.

The top white-collar crimes in India are Harshad Mehta Securities Fraud (1988-1995), Satyam Scam: The Biggest Corporate Accounting Fraud, Ketan Parekh Securities Scam, Sharada Chit Fund Case, Punjab National Bank Fraud, 2G Scam, CWG Scam.

White collar crime, in other words, corporate crime, was defined as financially prompted but non-violent crimes committed by government professionals, individuals and businesses.